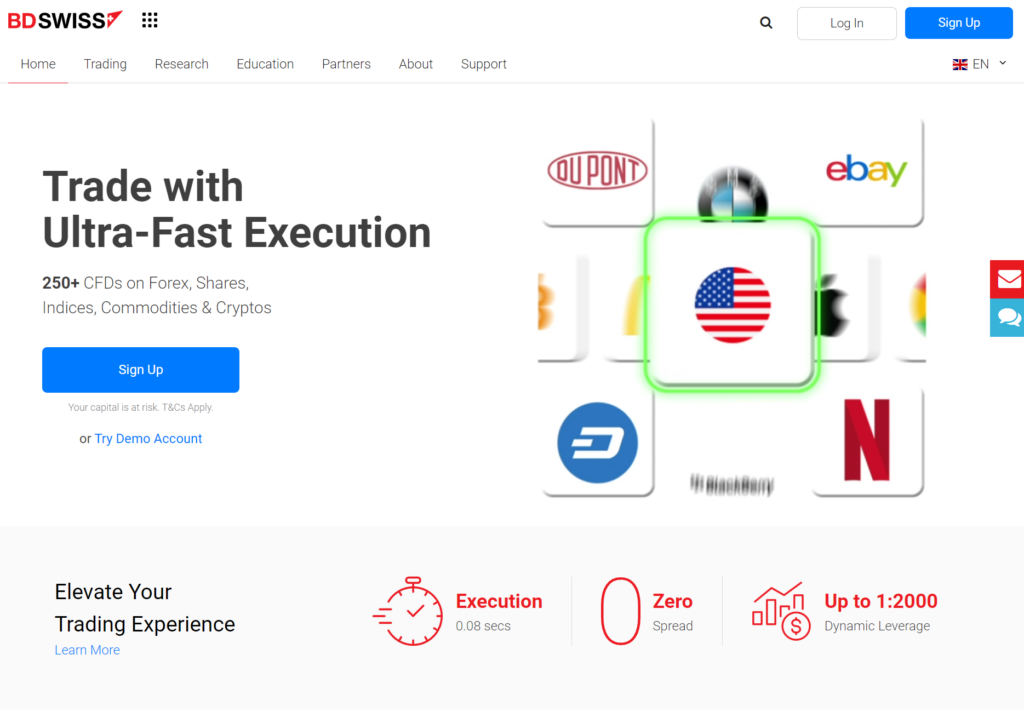

BDSwiss, established in 2012, is a reputable online trading platform offering a wide range of financial instruments for traders globally. Over the years, it has gained recognition for its user-friendly interface, extensive asset offerings, and commitment to regulatory compliance.

History and Background

Originally founded in Switzerland, BDSwiss has expanded its operations internationally, catering to traders from various regions. The company has continuously evolved its services to meet the changing demands of the financial markets, establishing itself as a trusted broker among retail and professional traders alike.

Key Features of BDSwiss

User Interface and Experience

BDSwiss prides itself on providing a seamless trading experience through its intuitive platform design. Whether accessing the platform via desktop or mobile devices, users can navigate effortlessly through different markets and execute trades efficiently.

Asset Classes Offered

Traders on BDSwiss have access to a diverse range of asset classes, including forex, commodities, stocks, indices, and cryptocurrencies. This extensive selection allows traders to diversify their portfolios and capitalize on various market opportunities.

Trading Platforms

BDSwiss offers multiple trading platforms, including MetaTrader 4 and MetaTrader 5, renowned for their advanced charting tools, technical analysis capabilities, and automated trading options. Additionally, the broker provides its proprietary platform, BDSwiss WebTrader, catering to traders seeking a simplified yet powerful trading solution.

Regulation and Security Measures

BDSwiss prioritizes the security of its clients’ funds and personal information. The company operates under the oversight of reputable regulatory authorities, such as CySEC (Cyprus Securities and Exchange Commission) and the FSC (Financial Services Commission) of Mauritius, ensuring compliance with strict regulatory standards.

Account Types and Minimum Deposits

Traders can choose from various account types on BDSwiss, each tailored to suit different trading preferences and experience levels. The minimum deposit requirement varies depending on the chosen account type, with options suitable for both novice and seasoned traders.

Trading Instruments and Options

Forex Trading

BDSwiss offers an extensive range of currency pairs for forex trading, providing traders with ample opportunities to capitalize on fluctuations in global currency markets.

CFD Trading

Contract for Difference (CFD) trading is another popular option on BDSwiss, allowing traders to speculate on price movements of various financial instruments without owning the underlying assets.

Cryptocurrency Trading

With the growing popularity of cryptocurrencies, BDSwiss enables traders to trade digital assets like Bitcoin, Ethereum, and Litecoin, offering exposure to this emerging asset class.

Fees and Commissions

BDSwiss operates on a transparent fee structure, with competitive spreads and low commissions on trades. Additionally, the broker offers fee-free deposits and withdrawals through a variety of payment methods.

Customer Support and Education Resources

BDSwiss is committed to providing exceptional customer support, with a dedicated team available 24/5 to assist traders with any inquiries or issues they may encounter. Furthermore, the platform offers a wealth of educational resources, including webinars, tutorials, and market analysis, to help traders enhance their trading knowledge and skills.

Pros and Cons

Pros:

- Regulated and reputable broker

- User-friendly trading platforms

- Diverse range of trading instruments

- Competitive fees and commissions

- Comprehensive customer support and educational resources

Cons:

- Limited availability of certain assets in certain regions

- Withdrawal processing times may vary depending on the chosen payment method

Conclusion

In conclusion, BDSwiss stands out as a reliable and user-friendly online trading platform, offering a wide range of financial instruments, competitive fees, and excellent customer support. With its commitment to regulatory compliance and security, BDSwiss continues to attract traders looking for a trustworthy broker to execute their trading strategies effectively.

FAQs

- Is BDSwiss regulated? Yes, BDSwiss is regulated by CySEC and the FSC of Mauritius, ensuring compliance with strict regulatory standards.

- What trading platforms does BDSwiss offer? BDSwiss offers MetaTrader 4, MetaTrader 5, and its proprietary platform, BDSwiss WebTrader.

- What is the minimum deposit required to open an account on BDSwiss? The minimum deposit requirement varies depending on the chosen account type, with options suitable for both novice and seasoned traders.

- Does BDSwiss offer cryptocurrency trading? Yes, BDSwiss enables traders to trade various cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

- What educational resources does BDSwiss provide? BDSwiss offers a variety of educational resources, including webinars, tutorials, and market analysis, to help traders enhance their trading knowledge and skills.

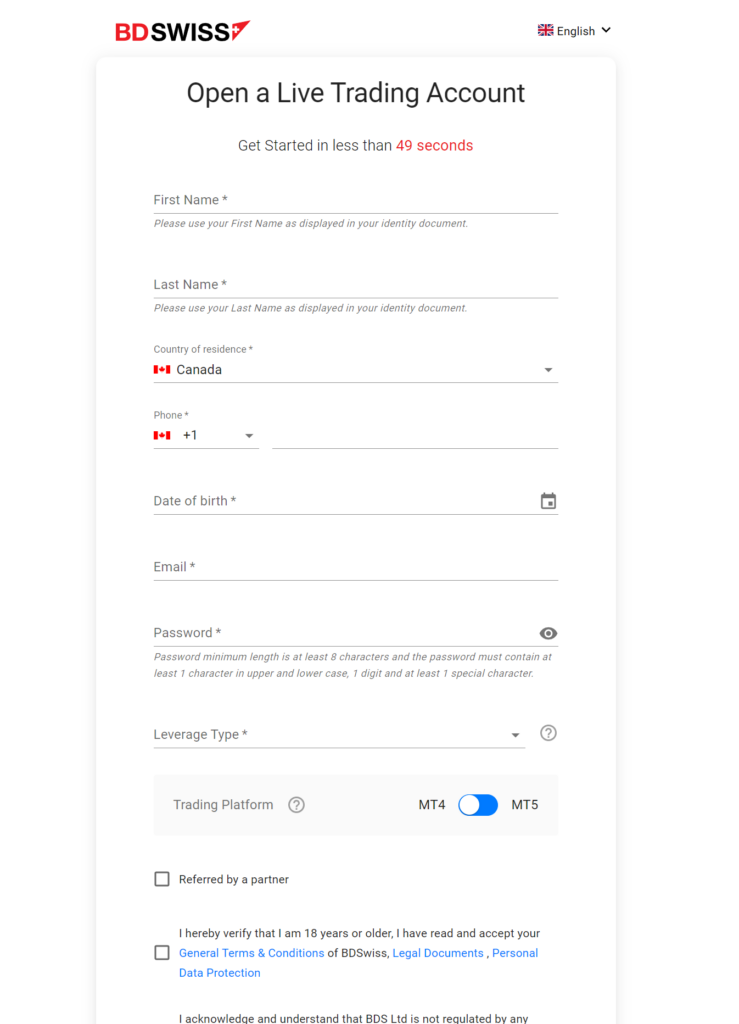

Sure, here’s a step-by-step guide on how to open an account with BDSwiss:

- Visit the BDSwiss Website: Go to the official BDSwiss website.

- Click on ‘Register’: Look for the ‘Register’ or ‘Sign Up’ button on the homepage and click on it.

- Fill in Your Details: Enter your personal information, including your name, email address, and phone number.

- Choose an Account Type: Select the type of account you want to open based on your trading preferences and experience level.

- Verify Your Identity: Follow the instructions to verify your identity by providing a copy of your identification documents.

- Make a Deposit: Once your account is verified, deposit funds into your account using the available payment methods.

- Start Trading: Once your funds are deposited, you can start trading on the BDSwiss platform using the available trading instruments.

- Manage Your Account: Monitor your trades, track your portfolio, and manage your account settings as needed.

- Withdraw Your Profits: When you’re ready to withdraw your profits, submit a withdrawal request through the platform, and follow the necessary steps to complete the process.

- Contact Customer Support: If you encounter any issues or have questions about the account opening process, don’t hesitate to reach out to BDSwiss customer support for assistance.

That’s it! You’re now ready to start trading on BDSwiss.

Leave a Reply