In the ever-evolving world of online trading, XM stands out as a beacon for both novice and experienced traders alike. This comprehensive review for 2024 aims to shed light on the features, benefits, and overall trading experience provided by XM, illustrating why it has become a top choice for investors around the globe. With a steadfast commitment to user satisfaction, cutting-edge technology, and a wide array of trading instruments, XM is not just a platform but a powerhouse in the Forex and CFD brokerage industry.

Why XM? A Closer Look at Its Unmatched Features

XM prides itself on offering a user-friendly interface that caters to traders of all levels. From advanced technical analysis tools to real-time market updates, the platform ensures that its users are well-equipped to make informed decisions. Furthermore, XM’s dedication to providing a fair and transparent trading environment is evident through its strict adherence to regulatory standards and practices.

Diverse Trading Instruments

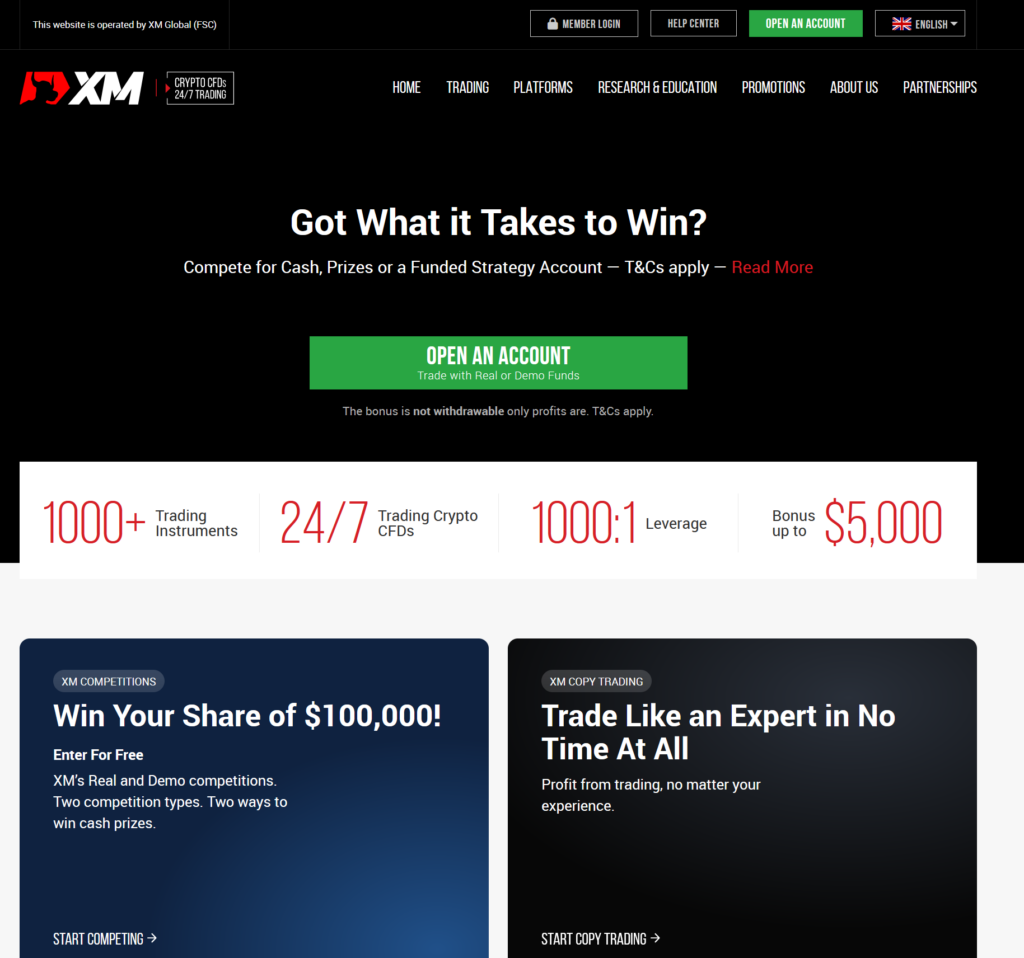

One of the standout aspects of XM is the sheer variety of trading instruments available. Whether you’re interested in Forex, stocks, commodities, or indices, XM has you covered with over 1000 instruments. This diversity not only allows traders to spread their investments but also offers ample opportunities to capitalize on different market trends.

Leverage and Margin Requirements

Leverage is a powerful tool in the hands of traders, and XM understands this. Offering leverage of up to 1:888, XM provides its clients with the potential to maximize their trading profits. However, it’s important to note that while leverage can increase profits, it can also amplify losses. XM educates its users on responsible trading practices to mitigate risk.

Educational Resources and Support

Education is at the heart of XM’s philosophy. The broker offers an extensive library of educational materials, including webinars, e-books, and tutorial videos. These resources are designed to help traders at every stage of their journey, from beginners to seasoned professionals. Additionally, XM’s customer support team is available 24/5 to answer any questions and assist with any issues.

Account Types and Customization

Understanding that every trader has unique needs, XM offers various account types, including Micro, Standard, and XM Zero accounts. Each account type comes with its own set of benefits, allowing traders to choose the one that best suits their trading style and goals. Customization extends to the trading platform itself, with options to personalize charts, indicators, and even the trading dashboard.

Security and Regulation: A Pillar of Trust

Security is paramount in online trading, and XM spares no effort in protecting its clients’ funds and personal information. Employing state-of-the-art security measures alongside strict regulatory compliance with multiple financial authorities, XM ensures a safe and secure trading environment for all its users.

Fast Withdrawals and Deposits

XM understands the importance of having access to your funds when you need them. That’s why the broker offers fast and hassle-free withdrawals and deposits, with a variety of payment methods including credit cards, e-wallets, and bank wire transfers. This commitment to convenience ensures that traders can manage their finances efficiently and effectively.

A Global Presence

With clients in over 190 countries and support in over 30 languages, XM’s global reach is unmatched. This international presence not only reflects the broker’s reliability and popularity but also its ability to cater to a diverse client base, understanding and meeting their specific needs.

Conclusion: XM – A Superior Trading Experience

In conclusion, XM stands as a leading broker in the Forex and CFD industry for good reason. Its commitment to excellence, comprehensive offering of services, and unwavering dedication to client satisfaction set it apart from the competition. Whether you’re just starting your trading journey or looking to elevate your trading strategy, XM provides the tools, resources, and support needed to succeed.

For traders seeking a broker that combines technology, diversity, education, and security, XM is the clear choice. As we move forward into 2024, XM continues to innovate and improve, promising an even more robust and rewarding trading experience for its global client base.

How to Open an Account with XM: A Step-by-Step Guide

- Visit XM Website: Go to the XM official website.

- Choose Your Account Type: Select from the available account types (e.g., Micro, Standard, XM Zero).

- Click on ‘Open an Account’: Find and click the ‘Open an Account’ button.

- Enter Personal Information: Fill in your personal details, including name, country of residence, email, and phone number.

- Complete the Registration Form: Provide additional details as required, such as birth date, address, trading experience, and financial information.

- Confirm Registration: Submit the registration form after reviewing your details.

- Verify Your Email: Check your email for a verification link from XM and click on it to verify your email address.

- Upload Documents: Provide proof of identity (ID or passport) and proof of residence (utility bill or bank statement) for account verification.

- Wait for Approval: Your account will be reviewed, and you will receive an email once it’s approved.

- Fund Your Account: Log in to your XM account, choose a deposit method, and add funds to your account.

- Download Trading Platform: Download the trading platform offered by XM, such as MT4 or MT5.

- Start Trading: With your account funded and platform installed, you’re ready to begin trading.

Ensure all the information you provide is accurate to avoid any delays in the account opening process.

Leave a Reply