ActivTrades is a leading online broker known for providing traders with access to a wide range of financial instruments across various markets. With a commitment to transparency, innovation, and client satisfaction, ActivTrades has established itself as a trusted partner for both novice and experienced traders alike.

History and Background

Founded in 2001, ActivTrades has steadily grown to become one of the most reputable brokers in the industry. Over the years, the company has garnered recognition for its integrity, reliability, and dedication to delivering exceptional trading services.

Account Types Offered

ActivTrades offers two main types of trading accounts to cater to the diverse needs of its clients:

Standard Account

The Standard Account is ideal for beginners and traders looking for a straightforward trading experience. With competitive spreads and no commissions on trades, this account provides a cost-effective solution for accessing the financial markets.

Professional Account

For experienced traders seeking advanced features and premium benefits, ActivTrades offers the Professional Account. This account type provides access to higher leverage, personalized support, and exclusive trading tools designed to enhance performance and profitability.

Trading Platforms

ActivTrades offers a choice of cutting-edge trading platforms, including:

MetaTrader 4

MetaTrader 4 is a popular platform known for its user-friendly interface, advanced charting tools, and customizable features. With access to a vast selection of indicators and trading strategies, MetaTrader 4 empowers traders to execute trades with precision and confidence.

MetaTrader 5

MetaTrader 5 builds upon the success of its predecessor with enhanced capabilities and improved performance. From advanced order types to built-in economic calendars, MetaTrader 5 offers a comprehensive trading experience tailored to the needs of modern traders.

Asset Classes Available

At ActivTrades, traders can access a diverse range of asset classes, including:

- Forex: Trade major, minor, and exotic currency pairs with competitive spreads and fast execution.

- Indices: Speculate on the performance of global stock indices, including the FTSE 100, S&P 500, and DAX.

- Commodities: Diversify your portfolio with commodities such as gold, silver, oil, and natural gas.

- Shares: Invest in leading companies from around the world, including tech giants, pharmaceutical firms, and financial institutions.

Regulation and Safety

ActivTrades is regulated by top-tier authorities, including the Financial Conduct Authority (FCA) in the United Kingdom and the Securities Commission of The Bahamas. These regulatory bodies ensure that the broker adheres to strict standards of financial stability, security, and investor protection.

Fees and Commissions

ActivTrades prides itself on its transparent fee structure, with competitive spreads and low commissions. Traders can enjoy tight spreads on a wide range of instruments, with no hidden fees or surprise charges.

Trading Tools and Features

In addition to its advanced trading platforms, ActivTrades offers a variety of tools and features to help traders succeed, including:

- Educational Resources: Access a wealth of educational materials, including webinars, tutorials, and trading guides.

- Analysis Tools: Utilize advanced charting tools, technical indicators, and market analysis to make informed trading decisions.

Customer Support

ActivTrades is committed to providing exceptional customer support to its clients. Whether you have a question about your account or need assistance with a trade, the broker’s team of knowledgeable representatives is available 24/5 to assist you.

Pros and Cons

Pros:

- Regulated by top-tier authorities

- Wide range of trading instruments

- User-friendly trading platforms

- Competitive spreads and low commissions

- Comprehensive educational resources

Cons:

- Limited availability of cryptocurrencies

- No live chat support

Conclusion

In conclusion, ActivTrades stands out as a reputable broker offering a diverse range of trading opportunities across global markets. With its commitment to transparency, innovation, and client satisfaction, ActivTrades continues to set the standard for excellence in online trading.

FAQs

- Is ActivTrades regulated?

- Yes, ActivTrades is regulated by the Financial Conduct Authority (FCA) in the UK and the Securities Commission of The Bahamas.

- What trading platforms does ActivTrades offer?

- ActivTrades offers MetaTrader 4 and MetaTrader 5, two of the most popular and widely used trading platforms in the industry.

- Does ActivTrades offer demo accounts?

- Yes, ActivTrades provides demo accounts for traders to practice their strategies and familiarize themselves with the platforms.

- What markets can I trade with ActivTrades?

- ActivTrades offers access to forex, indices, commodities, and shares, allowing traders to diversify their portfolios and capitalize on various opportunities.

- How can I contact ActivTrades customer support?

- You can contact ActivTrades customer support via email, phone, or by submitting a query through the broker’s website.

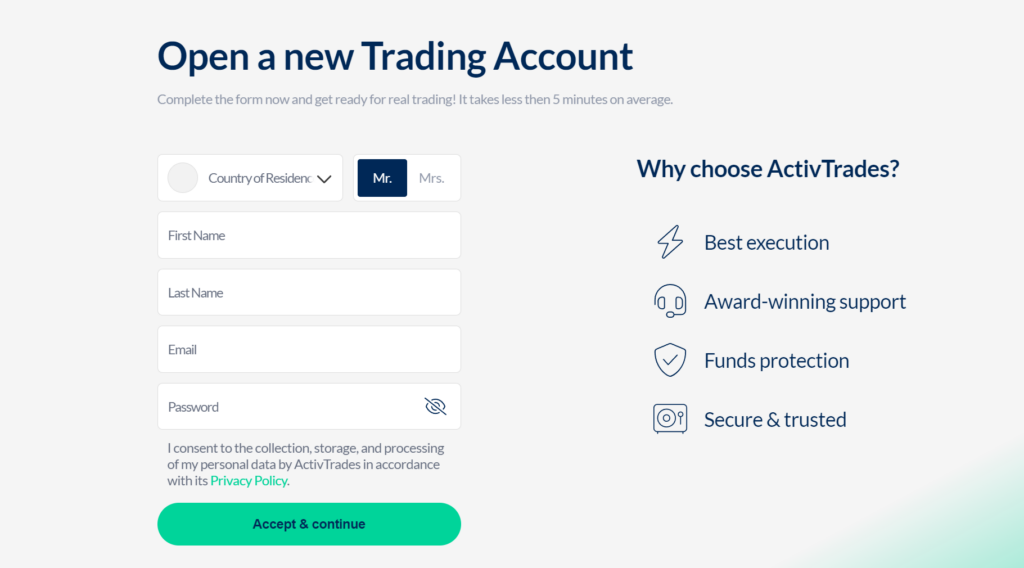

step-by-step guide on how to open an account with ActivTrades:

- Visit Website: Go to the ActivTrades website.

- Click “Open Account”: Look for the “Open Account” or “Sign Up” button and click on it.

- Fill Form: Complete the registration form with your personal details, including your name, email address, and phone number.

- Verify Identity: Follow the instructions to verify your identity. You may need to upload a copy of your identification documents, such as a passport or driver’s license.

- Choose Account Type: Select the type of account you want to open, such as a Standard or Professional account.

- Agree to Terms: Read and agree to the terms and conditions of ActivTrades.

- Submit Application: Review your information and submit your application.

- Fund Your Account: Once your account is approved, fund it with the minimum required deposit using your preferred payment method.

- Start Trading: Log in to your account using the credentials provided and start trading on the ActivTrades platform.

- Optional: Set up additional security measures, such as two-factor authentication, for added account protection.

That’s it! You’ve successfully opened an account with ActivTrades and can now start trading in the financial markets.

Leave a Reply