OctaFX is a global forex and CFD broker founded in 2011 that has experienced substantial growth over the years. They offer a range of trading platforms, competitive spreads, and various educational resources. Before signing up, let’s delve into a comprehensive review to see if OctaFX suits your trading needs.

Account Types

OctaFX caters to different trader experience levels with these account types:

- Micro Account: Geared towards beginners, with low minimum deposits and flexible lot sizes.

- Pro Account: Provides tighter spreads for more experienced traders.

- ECN Account: Offers direct market access for professionals, with the tightest spreads but commissions.

- Islamic (Swap-Free) Account: Designed for traders adhering to Sharia law, waiving overnight interest.

Trading Platforms

OctaFX supports some of the industry’s most popular platforms:

- MetaTrader 4 (MT4): The trusted industry standard, known for its charting tools and customizable interface.

- MetaTrader 5 (MT5): A more advanced version of MT4, with more timeframes and order types.

- cTrader: A platform with a sleek interface and fast execution speeds.

- OctaFX Copytrading: This feature lets you automatically replicate the trades of experienced traders.

Fees and Spreads

OctaFX prides itself on competitive pricing:

- Spreads: Vary based on account type and market conditions, generally tight on major forex pairs.

- Commissions: Charged on ECN accounts, depending on the asset traded.

- Swap Fees: Overnight fees on positions, but these are waived for Islamic accounts.

- Other Fees: Some withdrawal methods have associated fees.

Deposits and Withdrawals

OctaFX offers several funding options:

- Payment Methods: Bank transfers, credit/debit cards, e-wallets (like Skrill, Neteller).

- Processing Times: Varies by method, but often quick.

- Fees: Can be found on the OctaFX website.

Educational Resources

OctaFX has a strong emphasis on trader education:

- Market Analysis and News: Regular updates to keep you informed.

- Webinars and Tutorials: Live and on-demand resources for traders of all levels.

- Demo Accounts: Practice trading in a risk-free environment.

Customer Support

OctaFX prioritizes customer service:

- Live Chat: Available 24/7 for prompt assistance.

- Email and Phone: For detailed inquiries.

- Multilingual Support: Offers help in numerous languages.

Pros of OctaFX

- Low Spreads: OctaFX offers tight spreads, reducing trading costs.

- Range of Platforms: Traders have choices when it comes to their preferred trading interface.

- Copytrading Feature: A user-friendly way to potentially profit from experienced traders’ strategies.

- Strong Educational Content: Extensive resources to improve trading knowledge.

Cons of OctaFX

- Limited Range of Tradable Assets: Primarily focused on forex and CFDs, compared to some multi-asset brokers.

- Some High Withdrawal Fees: Certain withdrawal methods can be expensive.

- Regulation Could be Stronger: Not regulated by top-tier financial authorities.

Additional Things to Note

- Unique Bonuses and Promotions: OctaFX periodically runs attractive offers for traders.

- Negative Balance Protection: Ensures a trader’s account balance won’t fall below zero.

Overall Verdict

OctaFX stands out as a solid choice for forex and CFD traders, particularly those seeking cost-effective trading and good educational support. Be mindful of potential withdrawal fees and research if their range of instruments meets your needs. The availability of copytrading also makes it appealing for newer traders or those who lack time for intensive research.

Conclusion

OctaFX provides a decent mix of features for traders of varying experience levels. Their competitive spreads, educational tools, and social trading capabilities present potential advantages. If forex and CFDs are your primary interest, and you are comfortable with their regulation, OctaFX is worth considering. As always, weigh this review alongside your individual trading goals and risk tolerance.

FAQ

- Is OctaFX safe? OctaFX is regulated by CySEC, though not by top-tier authorities. They implement security measures such as segregated client funds.

- Does OctaFX offer a demo account? Yes, demo accounts are available to test strategies risk-free.

- How long does it take to withdraw from OctaFX? Time frames depend on the method. Usually processed within a few business days.

- Can US citizens use OctaFX? No, due to regulations OctaFX does not accept clients from the USA.

- Where is OctaFX headquartered? OctaFX is headquartered in Saint Vincent and the Grenadines.

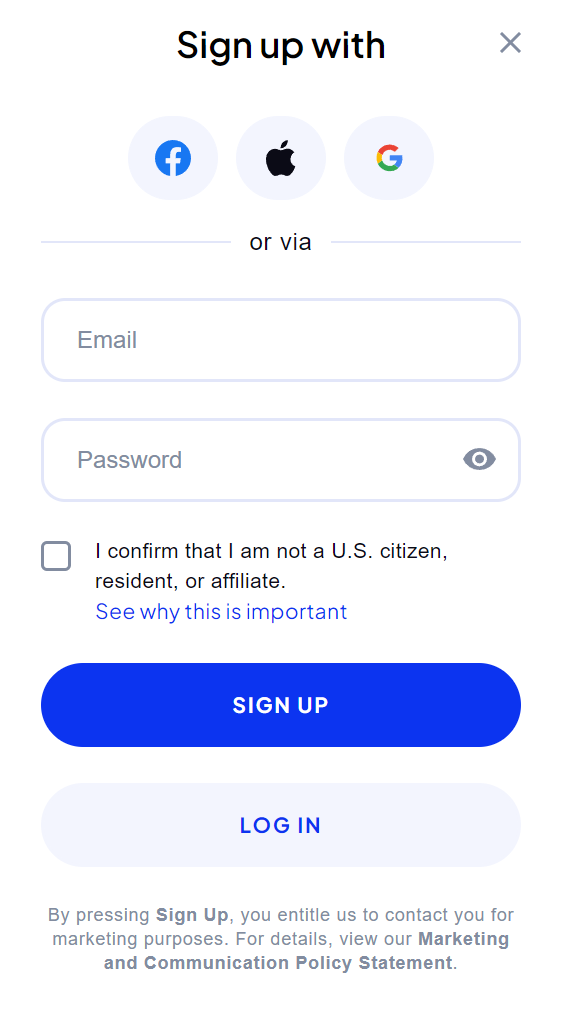

Step-by-Step Guide to Opening an OctaFX Account

- Visit the OctaFX website.

- Click on “Open Account” or “Register.”

- Fill out the registration form with your personal details.

- Verify your email address.

- Select your desired account type.

- Choose your trading platform.

- Make your initial deposit.

- Start trading!

Important: Read OctaFX’s terms and conditions carefully before signing up.

Leave a Reply