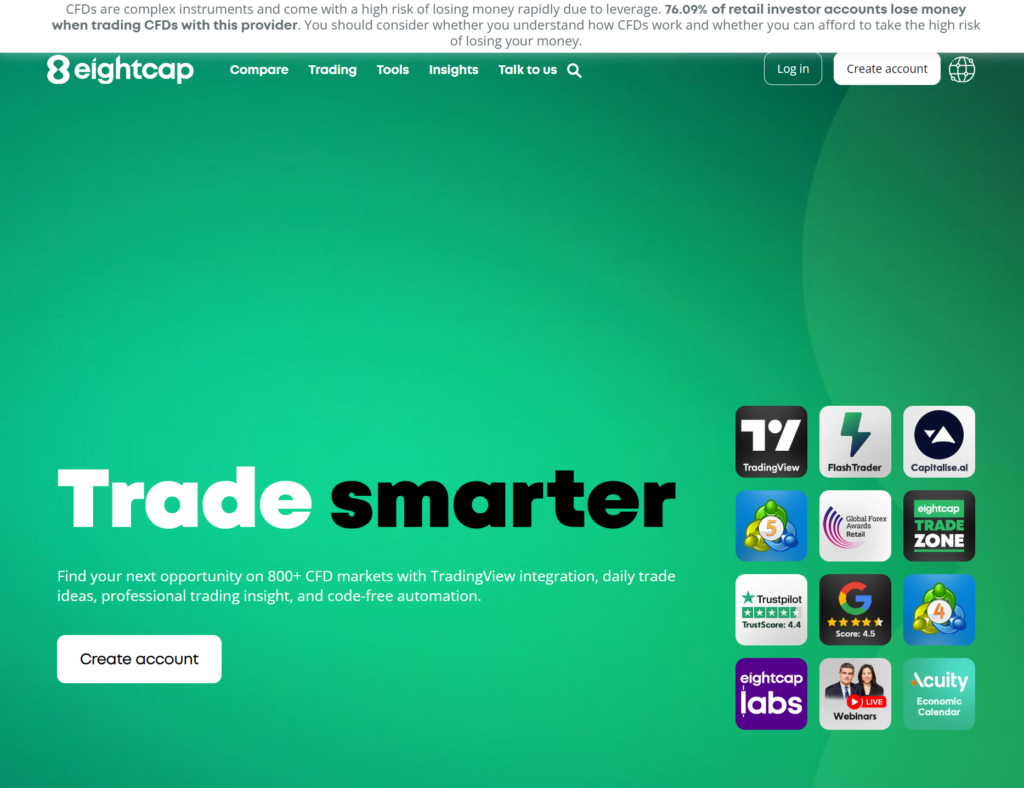

The world of online trading can feel like a vast ocean, filled with alluring opportunities and hidden dangers. Choosing the right broker is your anchor, ensuring a smooth and secure journey. In this comprehensive EightCap review, we’ll equip you with the knowledge to navigate the trading waters with confidence and determine if EightCap is your ideal vessel.

Who is EightCap?

Established in 2009, EightCap has carved its niche as a reliable CFD and forex broker. Headquartered in Australia, it boasts global reach, serving traders from various countries. But what truly sets them apart? Their commitment to regulation. EightCap is regulated by top-tier authorities like ASIC, FCA, and CySEC, offering peace of mind that your funds are safe and secure.

A Glimpse into the Regulatory Landscape

Navigating the unregulated waters of online trading can be perilous. Thankfully, EightCap prioritizes transparency and adherence to strict regulations. With ASIC (Australian Securities & Investment Commission), FCA (Financial Conduct Authority), and CySEC (Cyprus Securities and Exchange Commission) overseeing their operations, you can trade with the confidence that your interests are protected.

Diving Deep: Exploring EightCap’s Offerings

Now, let’s delve into the heart of the matter: What does EightCap offer you as a trader? Buckle up, because their arsenal is impressive.

A Bounty of Instruments: Forex, Crypto, and Beyond

Whether you’re a seasoned forex veteran or a crypto enthusiast, EightCap caters to your trading appetite. Dive into an extensive pool of currencies, explore over 800 CFDs on indices and commodities, or venture into the exciting realm of crypto with over 200 cryptocurrency pairs. They even offer CFDs on popular stocks, giving you diverse trading options under one roof.

Platform Powerhouse: MT4, MT5, and TradingView at Your Fingertips

Choice is the spice of life, and EightCap understands that. They offer not just one, but three powerful trading platforms to choose from: the industry-standard MetaTrader 4 (MT4), the advanced MetaTrader 5 (MT5), and the intuitive TradingView chart-based platform. Whether you prefer a classic interface or cutting-edge tools, you’ll find the perfect platform to suit your trading style.

Trading Experience: Unpacking the Essentials

Spreads and Commissions: Are They Competitive?

When it comes to trading costs, every penny counts. EightCap boasts competitive spreads across various instruments, especially on their Raw Account. However, remember, tighter spreads often come with higher commissions. Compare their offerings with other brokers and choose the account that aligns with your trading frequency and budget.

Execution Speed: Lightning-Fast or Lagging Behind?

Execution speed is paramount in the fast-paced world of trading. EightCap prides itself on its cutting-edge technology and robust infrastructure, ensuring swift order execution. Look for independent reviews and user testimonials to confirm their claims and ensure it aligns with your trading needs.

Customer Support: A Helping Hand When Needed

Navigating the intricacies of online trading can be daunting, even for experienced traders. EightCap offers multilingual customer support via phone, email, and live chat. Assess their responsiveness, expertise, and willingness to go the extra mile to ensure you’re well-supported on your trading journey.

Trust and Security: Cornerstones of Confidence

Regulatory Muscle: ASIC, FCA, and CySEC Backing

We already mentioned EightCap’s top-tier regulatory oversight, but it’s worth reiterating its importance. These regulations ensure segregation of client funds, adherence to fair trading practices, and robust complaint resolution mechanisms. This peace of mind allows you to focus on what matters most – making informed trading decisions.

Fund Security: Are Your Investments Protected?

EightCap takes fund security seriously. Client funds are held in segregated accounts with reputable banks, ensuring they’re not used for operational purposes. Additionally, negative balance protection safeguards your account from exceeding your deposited funds, further minimizing risk.

Additional Features: Unveiling the Extras

Educational Resources: Sharpening Your Trading Skills

EightCap recognizes that knowledge is power, offering a wealth of educational resources to empower traders of all levels. From webinars and articles to video tutorials and glossaries, you’ll find valuable tools to hone your trading skills and gain valuable insights.

Research and Analysis: Navigating Market Currents

Making informed trading decisions requires staying abreast of market trends and news. EightCap provides daily market analysis, economic calendars, and insights from experienced traders, equipping you with the knowledge to navigate the ever-changing market landscape.

Automation Tools: Trading on Autopilot?

While EightCap doesn’t offer fully automated trading, they integrate with Capitalise.ai, allowing you to build and backtest algorithmic trading strategies. This can be a valuable tool for experienced traders seeking to automate specific aspects of their trading strategy.

The Verdict: Is EightCap the Right Fit for You?

Weighing the Pros and Cons

Pros:

- Wide range of trading instruments

- Choice of three popular trading platforms

- Competitive spreads and commissions

- Regulated by top-tier authorities

- Strong focus on security and transparency

- Educational resources and market analysis

Cons:

- Limited educational resources compared to some competitors

- Higher commissions on Standard Account compared to Raw Account

- No fully automated trading options

Alternative Options: Exploring the Competition

Before making your final decision, consider alternatives like IG, Saxo Markets, or Pepperstone. Compare their offerings, regulatory standing, and fees to ensure you find the broker that best aligns with your individual needs and trading goals.

Conclusion: Charting Your Course with EightCap

EightCap offers a compelling proposition for traders seeking a diverse instrument selection, regulated security, and advanced platform options. Their educational resources and market analysis further empower you to make informed trading decisions. However, weigh their strengths and limitations against your trading goals and compare them to alternative brokers before charting your course. Remember, the ideal broker is not a one-size-fits-all solution, so choose wisely and trade with confidence!

FAQs: Demystifying EightCap

Is EightCap a safe and reliable broker?

Yes, EightCap is regulated by top-tier authorities like ASIC, FCA, and CySEC, ensuring adherence to strict regulations and client fund security.

What trading instruments does EightCap offer?

EightCap offers a wide range of instruments, including forex, cryptocurrencies, indices, commodities, and CFDs on popular stocks.

Which platform should I choose: MT4, MT5, or TradingView?

The best platform depends on your trading style and experience. MT4 is popular for its classic interface, while MT5 offers advanced features. TradingView caters to visual traders with its intuitive chart-based platform.

What are the fees and commissions associated with EightCap?

Fees vary depending on your account type and the instrument you trade. Compare their offerings with other brokers to find the most competitive option.

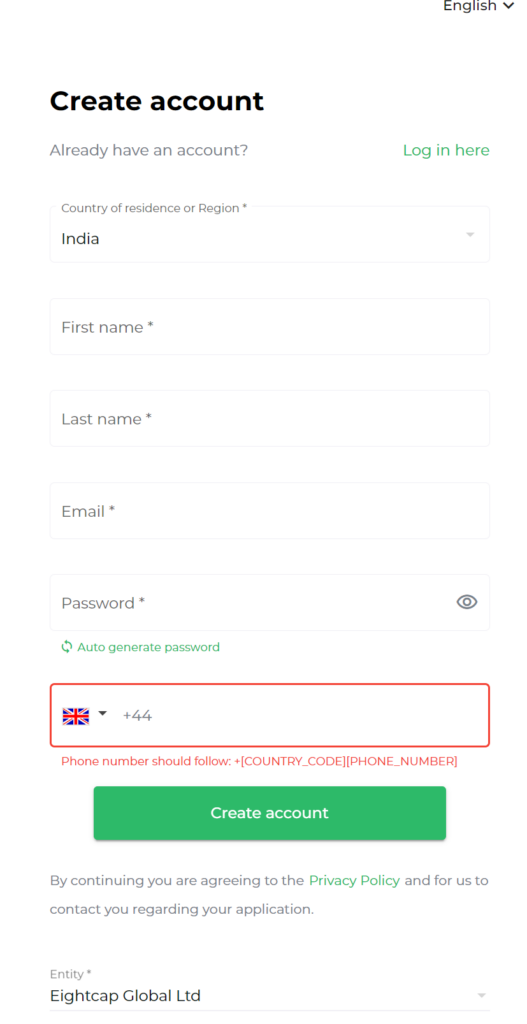

Step-by-Step Guide to Opening an EightCap Account:

1. Visit the EightCap Website and Click “Open Account”

Navigate to the EightCap website (https://www.eightcap.com/en/) and locate the “Open Account” button, typically found in the top right corner or on the homepage banner.

2. Choose Your Preferred Account Type

EightCap offers different account types, each with specific features and fee structures. Here’s a brief overview:

- Standard Account: Ideal for beginners with competitive spreads and lower commissions.

- Raw Account: Geared towards experienced traders with tighter spreads but higher commissions.

- Pro Account: For high-volume traders, offering tailored fees and dedicated support.

Choose the account that best suits your needs and trading style.

3. Provide Your Personal Information and Complete the Verification Process

Fill out the online application form with your personal details, including name, contact information, and tax residency. You’ll be required to upload some verification documents like a government-issued ID and proof of address.

4. Fund Your Account Using One of the Available Methods

EightCap accepts various funding methods, including credit/debit cards, bank transfers, e-wallets like Skrill and Neteller, and international wire transfers. Choose your preferred method and follow the on-screen instructions to deposit your initial funds.

5. Download and Install Your Chosen Trading Platform

EightCap offers MT4, MT5, and TradingView platforms. Select your preferred platform from the website and download the installation file. Follow the on-screen instructions to complete the installation.

6. Start Exploring the Market and Place Your First Trade!

Congratulations! You’ve successfully opened your EightCap account. Explore the platform, familiarize yourself with the features, and practice using demo accounts before placing your first live trade. Remember to start small, manage your risk, and trade responsibly.

Additional Tips:

- Read EightCap’s Terms and Conditions carefully before opening an account.

- Familiarize yourself with the platform’s features and functionalities.

- Utilize the educational resources and market analysis offered by EightCap.

- Start with small trades and gradually increase your investment as you gain experience.

- Always manage your risk and follow sound trading practices.

By following these steps and tips, you can smoothly open your EightCap account and embark on your trading journey with confidence. Remember, responsible trading and informed decision-making are key to success in the financial markets.

Leave a Reply