Unveiling the world of online trading can feel overwhelming, with a plethora of platforms vying for your attention. WeTrade emerges as a contender, particularly for those seeking a user-friendly forex and CFD trading experience. But is it the right fit for you? This comprehensive WeTrade review in 2024 dives deep into the platform’s features, fees, and overall effectiveness, empowering you to make informed decisions for your trading journey.

Exploring the Trading Arena: Assets and Markets Offered

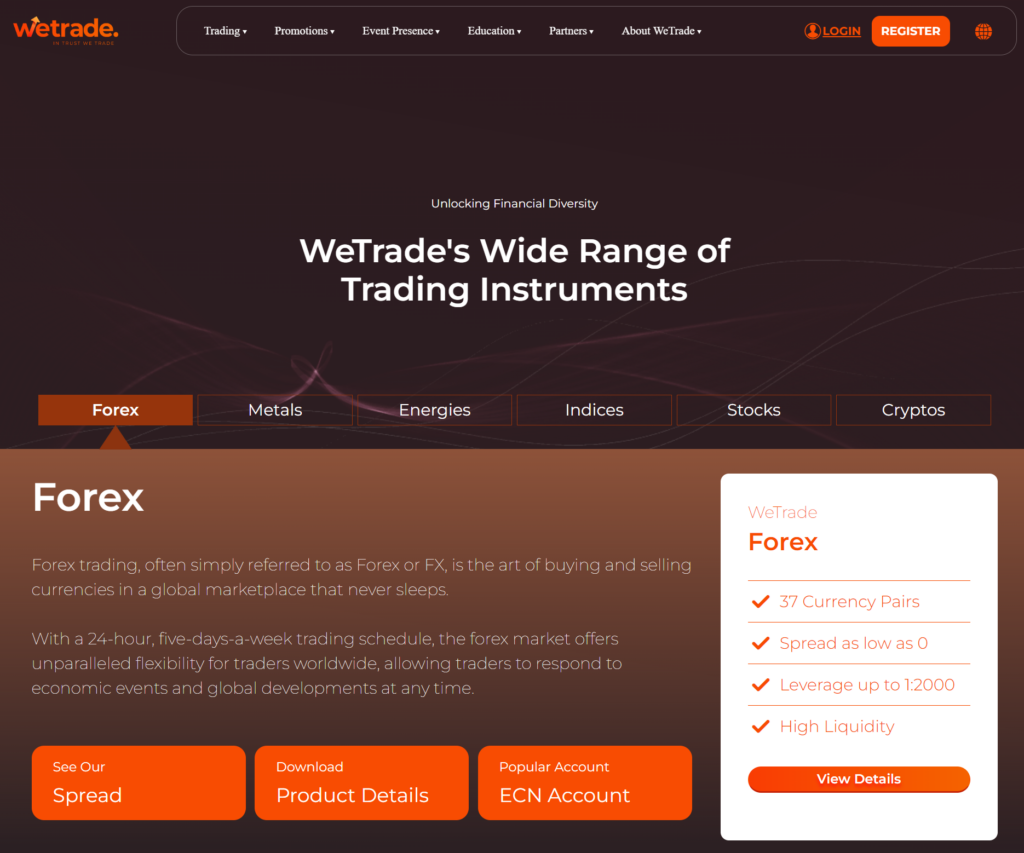

WeTrade caters to diverse trading interests by offering a range of assets, including:

- Forex: Trade major, minor, and exotic currency pairs with varying leverage options.

- Stocks: Invest in popular companies across various sectors from global markets.

- Commodities: Gain exposure to valuable resources like gold, oil, and natural gas.

- Indices: Trade popular stock market indices like the S&P 500 and the DAX 30.

Unveiling the Trading Platform: A User’s Perspective

WeTrade leverages the well-established MetaTrader 4 (MT4) platform, renowned for its user-friendly interface and extensive customization options. Beginners will appreciate the platform’s intuitive design, while experienced traders can utilize advanced charting tools and technical indicators to refine their strategies.

Gearing Up for Success: Account Types and Minimum Deposit

WeTrade offers several account types to suit different trading needs and risk tolerances. The standard account caters to most traders with a $100 minimum deposit, while the Islamic account adheres to Sharia law principles.

Fees and Spreads: Understanding the Cost of Trading

It’s crucial to understand the cost of trading before diving in. WeTrade charges spreads, the difference between the buy and sell prices of an asset, and may also have commission fees depending on the asset and account type. While WeTrade’s fees are generally competitive, it’s essential to compare them to other platforms to find the best fit for your budget.

Educational Resources: Empowering Your Trading Journey

WeTrade recognizes the importance of knowledge and equips users with various educational resources. From comprehensive webinars and video tutorials to detailed glossaries and market analysis reports, the platform empowers you to gain the necessary skills and confidence to navigate the trading landscape.

Customer Support: A Lifeline for Traders

Whether you’re a seasoned trader or a curious newcomer, encountering obstacles is inevitable. WeTrade provides customer support through live chat, email, and phone, ensuring you receive timely assistance whenever needed. The multilingual support team further enhances accessibility for a global audience.

Social Trading: Learning from the Masters (Optional)

If you’re keen on observing and potentially replicating the strategies of successful traders, WeTrade’s social trading feature might be appealing. This functionality allows you to follow experienced traders and potentially copy their trades, potentially offering valuable insights and learning opportunities. However, remember that past performance is not necessarily indicative of future results, and social trading carries inherent risks.

Security and Regulations: Building Trust in the Trading Environment

WeTrade implements industry-standard security measures to safeguard user data and financial information. This includes encryption protocols and secure login procedures. While WeTrade currently operates under an offshore regulatory license, it’s crucial to stay updated on any future regulatory developments, as regulations play a vital role in ensuring the legitimacy and security of online trading platforms.

Advantages and Disadvantages: Weighing the Pros and Cons

Advantages:

- User-friendly MT4 platform

- Diverse range of assets

- Educational resources and customer support

- Social trading feature (optional)

Disadvantages:

- Limited regulatory oversight (as of March 2024)

- Potentially higher fees compared to some competitors

Alternatives: Exploring the Competitive Landscape

It’s always wise to compare options before committing. Explore popular platforms like eToro, AvaTrade, and XM to identify the one that best aligns with your needs and preferences in terms of features, fees, and regulations.

The Final Verdict: Is WeTrade the Right Choice for You?

Ultimately, the decision of whether WeTrade is the right platform for you hinges on your individual trading goals, risk tolerance, and experience level. If you’re a beginner seeking a user-friendly platform with educational resources and basic asset variety, WeTrade might be a viable option. However, if regulatory oversight and potentially lower fees are paramount, exploring alternative platforms might be prudent.

Conclusion: A Comprehensive Guide to Navigating WeTrade

This WeTrade review has equipped you with valuable insights into the platform’s functionalities, fees, and potential advantages and limitations. Remember, conducting your own research and due diligence is crucial before venturing into the world of online trading. Consider your risk tolerance, investment goals, and individual needs to make informed decisions that align with your financial objectives.

How to Open a WeTrade Account: A Step-by-Step Guide

Opening a WeTrade account is a straightforward process that can be completed in a few minutes. Here’s a step-by-step guide:

- Visit the WeTrade website: Navigate to the official WeTrade website using your preferred web browser.

- Click “Open Account”: Locate the “Open Account” button, typically found on the homepage or in the registration section.

- Choose your account type: Select the account type that best suits your needs. Standard accounts are suitable for most users, while Islamic accounts cater to those adhering to Sharia law principles.

- Enter your personal information: Fill out the online form with your personal details, including your name, email address, phone number, and country of residence.

- Verify your identity and address: WeTrade requires identity and address verification for security purposes. Upload the necessary documents, such as a government-issued ID and proof of address (utility bill, bank statement).

- Fund your account: Choose your preferred deposit method from the available options, such as credit card, debit card, or bank transfer. Enter the desired deposit amount and follow the on-screen instructions to complete the transaction.

- Download and install MT4: Download the MetaTrader 4 platform compatible with your device (computer, mobile phone). Follow the installation instructions provided by WeTrade.

- Log in to your account: Launch the MT4 platform and log in using your WeTrade account credentials.

- Explore and trade: Familiarize yourself with the platform’s features and functionalities. Explore the available markets, analyze charts, and execute trades based on your chosen strategy.

Important Note: This guide provides a general overview of the account opening process. Specific steps or requirements might change over time, so it’s recommended to double-check the latest information directly on the WeTrade website.

By following these steps, you’ll be well on your way to starting your trading journey with WeTrade. Remember, responsible trading involves thorough research, risk management, and a clear understanding of the market before investing your hard-earned money.

Leave a Reply