The world of online trading can be a daunting landscape, filled with complex platforms, diverse instruments, and seemingly endless choices for brokers. But fear not, intrepid investor! This AAFX Trading review for 2024 aims to be your compass, guiding you through the features, fees, and overall experience AAFX offers.

Who is AAFX Trading, and who are they for?

AAFX Trading positions itself as a user-friendly online broker, catering to both novice and experienced traders. They boast a wide range of tradable instruments, including forex, stocks, commodities, and cryptocurrencies. Whether you’re a seasoned currency trader or just dipping your toes into the world of stock investing, AAFX might have something to offer.

Navigating the AAFX Trading Marketplace

AAFX equips traders with two popular platforms: MetaTrader 4 and MetaTrader 5. These industry-standard platforms are known for their user-friendly interface, advanced charting tools, and automated trading capabilities.

But what can you actually trade with AAFX? The answer is a diverse selection:

- Forex: Trade major, minor, and exotic currency pairs with competitive spreads.

- Stocks: Invest in a variety of companies from various global exchanges.

- Commodities: Trade gold, oil, and other commodities to diversify your portfolio.

- Cryptocurrencies: Gain exposure to the ever-evolving world of digital assets.

Account Options to Suit Your Trading Style

AAFX caters to different trading styles and risk appetites with three account types: Fixed, ECN, and VIP. The Fixed Account offers the advantage of predictable spreads, while the ECN Account provides tighter spreads and direct access to the market. The VIP Account, with its even tighter spreads and additional benefits, is tailored towards high-volume traders.

Fees and Spreads: What to Expect

AAFX prides itself on being a cost-effective broker. They don’t charge commissions, and swap fees are absent, making them an attractive option for traders who want to keep their costs low. Spreads, however, vary depending on the account type and the instrument being traded.

It’s crucial to compare AAFX’s spreads with other brokers to ensure you’re getting a competitive deal. Remember, even a small difference in spreads can significantly impact your profitability, especially for high-frequency traders.

Customer Support: Your Trading Journey’s Lifeline

AAFX offers 24/7 customer support through various channels, including live chat, email, and phone. This ensures you have someone to turn to whenever you encounter issues or have questions, regardless of the time zone you’re in.

The quality of customer support can significantly impact your overall trading experience. While prompt response times are essential, the ability of the support team to address your concerns efficiently is equally important.

Security and Regulation: Keeping Your Investments Safe

AAFX is regulated by the Financial Services Authority (FSA) of St. Vincent and the Grenadines. While this might not be the most stringent regulatory environment compared to some other jurisdictions, AAFX employs additional security measures to protect client funds. These include segregated accounts, ensuring your money is kept separate from the company’s operational funds, and SSL encryption to safeguard your data during transactions.

AAFX Trading: Weighing the Pros and Cons

Pros:

- Wide range of tradable instruments

- User-friendly MetaTrader platforms

- Competitive spreads for certain account types

- No commission fees

- 24/7 customer support

Cons:

- Limited regulatory oversight

- Spreads can be higher for some instruments compared to competitors

- Educational resources might be limited compared to some brokers

AAFX Trading vs. the Competition

Choosing the right broker depends on your individual needs and preferences. It’s crucial to compare AAFX with other brokers in terms of fees, regulations, platform features, and customer support before making a decision.

Some factors to consider when comparing brokers include:

- Regulation: Look for brokers regulated by reputable authorities.

- Fees: Compare commission fees, spreads, and other non-trading charges.

- Instruments: Ensure the broker offers the instruments you want to trade.

- Platforms: Choose a platform that aligns with your technical expertise and preferences.

- Customer support: Evaluate the quality and availability of customer support.

Is AAFX Trading Right for You?

AAFX Trading can be a suitable option for traders seeking a user-friendly platform, a diverse range of instruments, and competitive fees. However, it’s essential to be aware of the potential drawbacks, such as limited regulatory oversight and potentially higher spreads for certain instruments compared to competitors.

Conclusion

The financial markets can be an exciting yet challenging arena. AAFX Trading offers a platform and tools to navigate this landscape, but it’s crucial to approach any investment venture with caution and thorough research.

Before diving in, consider your risk tolerance, investment goals, and experience level. Remember, past performance is not necessarily indicative of future results, and any investment carries inherent risks.

FAQs

1. Is AAFX Trading a safe broker?

AAFX is regulated by the FSA of St. Vincent and the Grenadines, and they implement security measures like segregated accounts and SSL encryption. However, it’s important to remember that no regulatory framework eliminates all risks associated with online trading.

2. What are the minimum deposit requirements at AAFX Trading?

The minimum deposit requirement varies depending on the account type you choose. The Fixed and ECN Accounts require a minimum deposit of $100, while the VIP Account requires a minimum of $5,000.

3. Does AAFX Trading offer any educational resources?

AAFX offers some educational resources, including eBooks and market research reports. However, compared to some other brokers, their educational resources might be limited.

4. How can I contact AAFX Trading customer support?

AAFX offers 24/7 customer support through live chat, email, and phone.

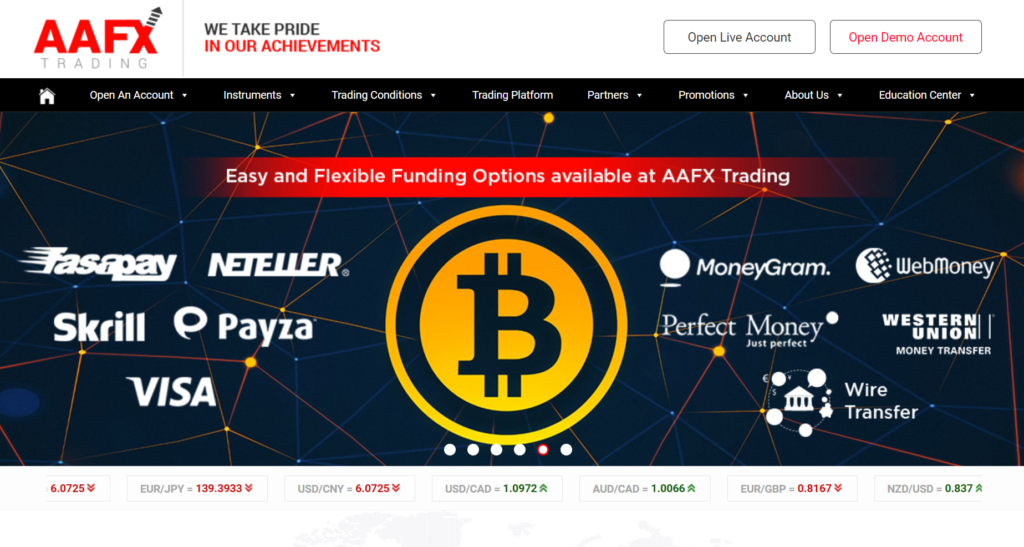

5. What are the payment methods accepted by AAFX Trading?

AAFX accepts various payment methods, including credit cards, debit cards, bank transfers, and e-wallets.

Remember, this AAFX Trading review is intended for informational purposes only and should not be considered financial advice. It’s essential to conduct your own research and consult with a financial professional before making any investment decisions.

Opening an AAFX Trading Account: A Step-by-Step Guide

Ready to embark on your trading journey with AAFX? Here’s a simplified guide to opening an account:

- Visit the AAFX Trading website: Head to their official website and locate the “Open Account” button, usually prominent on the homepage.

- Fill out the registration form: Provide your personal information, including your full name, email address, and phone number. Ensure the information is accurate and matches your government-issued identification documents.

- Choose your account type: AAFX offers three account options: Fixed, ECN, and VIP. Each caters to different trading styles and risk tolerances. Carefully review the features and benefits of each account type before making your selection.

- Verify your identity: Upload the required documents for verification, such as a passport, driver’s license, or national identity card. This process ensures compliance with regulations and protects your account from unauthorized access.

- Fund your account: Once your account is verified, choose your preferred deposit method from the available options, such as credit cards, debit cards, bank transfers, or e-wallets. Enter the desired deposit amount and follow the on-screen instructions to complete the transaction.

- Download and install the platform: AAFX utilizes the popular MetaTrader 4 and MetaTrader 5 platforms. Download and install the platform compatible with your device (computer, mobile, tablet) from the AAFX website or the respective platform website.

- Login and start trading: Once the platform is installed and your account is funded, use your login credentials to access your trading account. Explore the platform, familiarize yourself with the features, and start exploring the vast range of tradable instruments offered by AAFX.

Leave a Reply