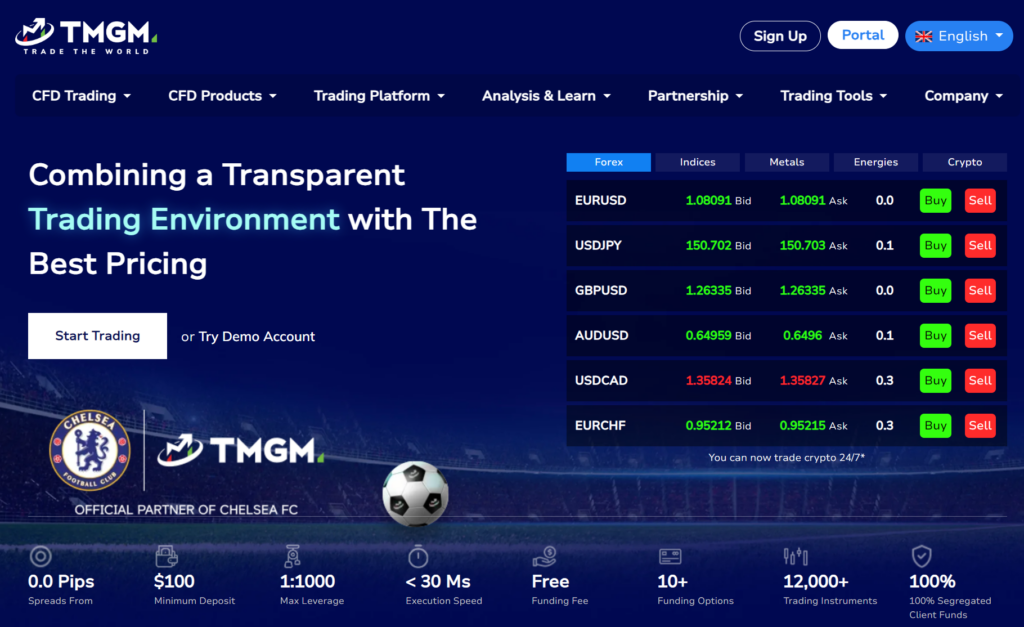

Established in Sydney, Australia, Trademax Global Markets (TMGM) is a well-known online broker serving traders across the globe. Specializing in forex and CFD trading, the broker has carved out a reputation for tight spreads, fast execution, and a focus on innovative technology. This TMGM Review for 2024 will delve into the core aspects of the platform, helping you decide if it aligns with your trading needs.

About TMGM

TMGM traces its roots back to 2013. The company’s growth has been impressive, and it currently boasts offices worldwide. Importantly, TMGM operates under the watchful eye of reputable regulatory bodies, including:

- Australian Securities & Investments Commission (ASIC)

- Vanuatu Financial Services Commission (VFSC)

These licenses offer traders a degree of assurance, as the regulations are in place to protect client funds and promote fair trading practices.

Trading Platforms

TMGM recognizes the popularity of the MetaTrader platforms and gives its clients a choice between MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 remains the go-to choice for seasoned forex traders, while MT5 caters to those desiring a broader range of assets and advanced features. Both platforms offer robust capabilities:

- User-friendly interface

- Wide selection of technical indicators and charting tools

- Customizable layouts

- Support for automated trading (Expert Advisors)

Account Types

TMGM offers account types to cater to varying trading requirements. The main options include:

- Edge Account: Standard commission-free account with slightly wider spreads.

- Classic Account: Lower spreads, but with a commission charged per trade.

The minimum deposit for both account types is a reasonable $100. TMGM also provides Islamic swap-free accounts.

Spreads, Commissions, and Fees

TMGM’s pricing structure offers competitive spreads. In the Edge Account, typical spreads on major forex pairs like EUR/USD can start from 1 pip. The Classic Account boasts spreads from 0 pips but incurs a commission of $7 per round turn lot traded. Fees on other asset classes and for actions such as overnight holding will vary. It’s essential to check TMGM’s website for the most up-to-date and detailed fee schedule.

Asset Classes

TMGM provides traders with the ability to trade a diverse range of instruments:

- Forex: An impressive selection of major, minor, and exotic currency pairs.

- CFDs: Contracts for Difference on assets like stocks, indices, commodities (energies, metals), and even cryptocurrencies.

Deposits and Withdrawals

TMGM facilitates deposits and withdrawals through various methods:

- Credit/debit cards

- Bank transfers

- E-wallets (Skrill, Neteller, etc.)

Processing times can vary according to method and region. TMGM generally does not charge deposit fees but be sure to check with your payment provider for any potential charges on their end.

Trading Tools and Features

TMGM goes beyond the basics, offering tools to enhance your trading experience:

- Advanced charting options: Candlesticks, line charts, and more, plus a suite of drawing tools.

- Technical indicators: Popular indicators built-in, with the option for custom indicators.

- Market news and analysis: Keep on top of market-moving events.

- Economic calendar: Anticipate key macroeconomic releases.

- Educational Resources: Webinars, articles, and more to expand your trading knowledge.

Customer Support

TMGM values customer support and provides multiple channels to reach out:

- Live Chat: For immediate inquiries

- Email Support: Submit a help ticket

- Telephone: Available in several locations

Their support team is known for being responsive and aims to resolve issues promptly.

Advantages of TMGM

- Tight spreads

- Regulated by reputable authorities

- User-friendly MetaTrader platforms

- Choice of Account Types

- Diverse range of tradable assets

Disadvantages of TMGM

- Limited research and analysis offerings

- MetaTrader platforms might not appeal to everyone

- Educational resources could be more comprehensive

Absolutely! Here’s the continuation of the TMGM Review:

Who is TMGM Best For?

TMGM can be a good fit forvarious trader profiles, including:

- Novice traders: Intuitive Metatrader platforms and basic educational resources offer a manageable start.

- Experienced traders: Competitive pricing, reliable execution, and MT4/MT5 suit seasoned traders well.

- Algorithmic traders: The platforms’ support for EAs is a plus for those using automated strategies.

- Traders seeking asset variety: Forex and CFDs offer a wide array of market exposure.

Conclusion

Overall, TMGM emerges as a reliable broker with a strong emphasis on providing competitive conditions. Its regulated status, popular platforms, and diverse instrument selection make it a contender worthy of consideration. Whether you’re a beginner seeking an approachable entry point or a seasoned trader prioritizing tight spreads, TMGM warrants a closer look.

FAQs

1. Is TMGM a safe broker? TMGM operates under regulation from reputable bodies (ASIC, VFSC), promoting a higher degree of trustworthiness in terms of client fund safety and fair operating practices.

2. What are the minimum deposit requirements? TMGM has a relatively low entry point, with the minimum deposit requirement being $100.

3. Does TMGM offer demo accounts?

Yes, TMGM allows you to practice trading in a risk-free simulated environment with a demo account.

4. Can I trade cryptocurrencies with TMGM? You can gain exposure to popular cryptocurrencies via CFDs on TMGM’s platform.

5. How is TMGM’s customer support? TMGM’s customer support is generally well-regarded, with options like live chat, email, and phone support for convenient assistance.

How to Open a TMGM Account: Step-by-Step Guide

- Visit the TMGM website: Navigate to TMGM’s official website.

- Click “Open Account”: Locate the button or tab to start the registration process.

- Choose account type: Select either the Edge or Classic account, considering your trading style and preferences.

- Provide personal information: Fill out the form with accurate details, including name, address, and contact information.

- Verify identity: Follow TMGM’s instructions, which likely involve uploading proof of identity (government ID) and proof of residence (utility bill).

- Fund your account: Once verified, choose your deposit method and add funds to your new TMGM account.

- Start trading: You’re all set! Log in to the MetaTrader platform and begin your trading journey with TMGM.

Leave a Reply