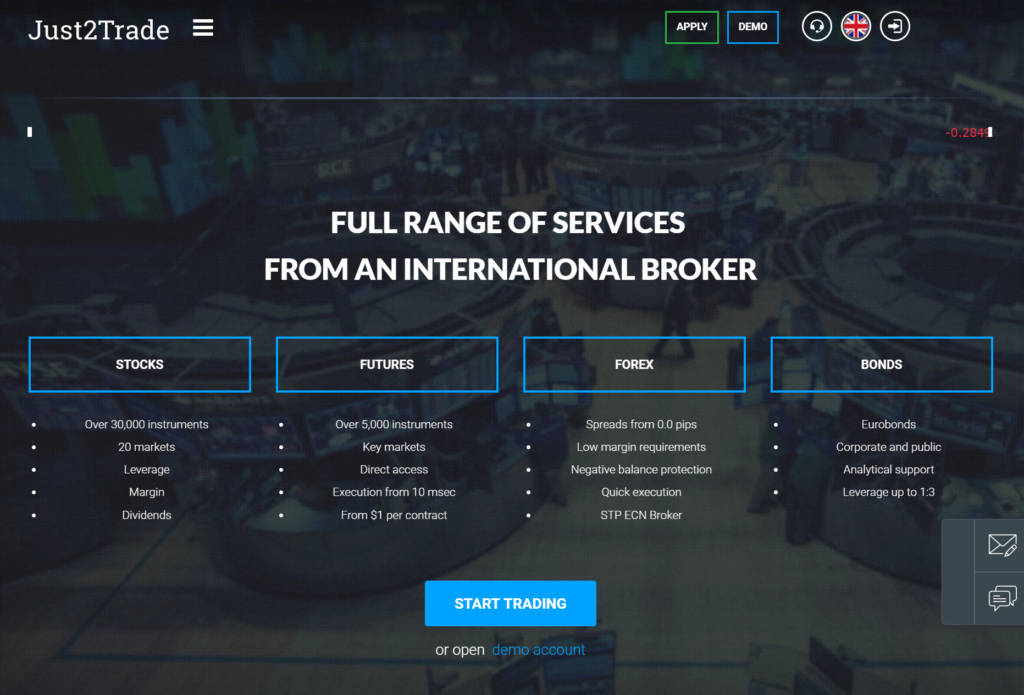

Just2Trade is an established online broker that provides traders and investors with access to a diverse range of financial markets. The platform offers various account types to accommodate individual and corporate needs. While catering to different experience levels, it may be particularly appealing to those seeking a balance of affordability and robust trading tools.

Key Features

- Trading platforms and available tools: Just2Trade boasts multiple trading platforms, including desktop, web-based, and mobile applications. The platforms come equipped with charting tools, technical indicators, news feeds, and other features to support trading decisions.

- Range of tradable assets: Traders can access a wide array of assets including stocks, ETFs (exchange-traded funds), forex, options, futures, and even cryptocurrencies.

- Research and educational resources: Just2Trade provides market analysis, news, and educational content to help traders make informed decisions.

- Unique features: Some features that distinguish Just2Trade include the option for demo accounts and potential participation in social trading networks.

Fees and Pricing

- Account opening and maintenance fees: Opening an account with Just2Trade may or may not involve fees, depending on the account type. Some accounts may also be subject to monthly maintenance fees.

- Commissions: Just2Trade’s commission structures vary depending on the asset class being traded. They offer competitive pricing, especially for high-volume traders.

- Inactivity fees: It’s important to check if Just2Trade charges inactivity fees in case your account remains dormant for an extended period.

- Other potential fees: Familiarize yourself with any potential withdrawal, transfer, or additional service-related fees charged by the broker.

Account Opening Process

- Eligibility: Just2Trade may have specific residency or age requirements.

- Steps involved The account opening process typically involves an online application, identity verification, and potentially funding the account.

- Approval timelines: The speed of the process can vary depending on factors like the completeness of your application and regulatory requirements.

Trading Platforms

- Desktop platform: Just2Trade’s desktop platform is likely its most comprehensive offering, providing a suite of advanced tools and customization possibilities.

- Mobile app: A mobile app allows for on-the-go trading and account management, available for common operating systems.

- Web-based trader: If available, a web-based trader offers convenient access to markets through a web browser.

Pros and Cons

- Advantages of Just2Trade

- Competitive pricing

- Wide asset selection

- Variety of trading platforms

- Potential for demo accounts

- Disadvantages of Just2Trade

- May not be ideal for absolute beginners seeking extensive handholding

- Some fees could be complex for novice traders

Customer Service

- Methods of contact: Just2Trade typically offers support through phone, email, and potentially live chat options.

- Availability and responsiveness: Consider their support hours and average response times.

- Reputation: Look into the broker’s reputation for providing helpful and efficient customer service.

Is Just2Trade Right for You?

- Ideal trader profile: Just2Trade could be a good fit if you value a mix of affordability and capable trading tools and are comfortable with a degree of self-direction.

- Factors to consider: Evaluate the platform based on the fees, specific assets you want to trade, your experience level, and the importance you place on customer support.

Conclusion

Just2Trade presents itself as a versatile brokerage option for traders seeking competitive pricing and a solid range of assets and tools. Its offering may be particularly attractive if you are comfortable navigating a trading platform without extensive guidance. Before signing up, carefully assess the various fees and features to ensure that Just2Trade aligns with your individual trading needs and goals.

Leave a Reply