Binary options trading has gained significant popularity over the years, offering traders an opportunity to speculate on various financial markets with limited risk. One prominent platform in this space is Nadex, short for North American Derivatives Exchange. In this Nadex review for 2024, we’ll delve into what makes Nadex unique, its advantages and disadvantages, user experience, fees, security measures, trading tips, and more.

1. Introduction to Nadex

Nadex is a leading binary options exchange based in the United States. It provides a platform for traders to participate in derivatives trading on a range of financial markets, including forex, commodities, stock indices, and economic events.

2. What is Nadex?

Nadex operates as a regulated exchange where traders can buy and sell binary options and spreads. Unlike traditional options trading, where contracts are bought and sold between investors, Nadex acts as a facilitator for these transactions, offering a transparent marketplace for traders to execute their trades.

3. History of Nadex

Established in 2004, Nadex has a relatively long history in the derivatives trading industry. It is regulated by the Commodity Futures Trading Commission (CFTC), ensuring that it operates within the legal framework set forth for financial exchanges in the United States.

4. How Does Nadex Work?

Nadex offers various trading instruments, including binary options, spread contracts, and call/put options. Traders can choose their preferred instrument based on their trading strategy and market outlook.

5. Advantages of Nadex

One of the primary advantages of Nadex is its regulatory oversight. Being regulated by the CFTC instills confidence in traders that the platform operates transparently and ethically. Additionally, Nadex offers limited risk trading, where traders can only lose the amount they’ve invested in a particular trade.

6. Disadvantages of Nadex

Despite its advantages, Nadex also has some drawbacks. The platform has a limited range of assets compared to other trading platforms, which may restrict trading opportunities for some traders. Moreover, the complexity of trading strategies on Nadex may deter novice traders from fully utilizing the platform.

7. Nadex Review 2024: User Experience

In 2024, Nadex continues to provide a user-friendly trading interface. Traders can easily navigate the platform, execute trades, and access essential trading tools. The customer support team is responsive and knowledgeable, assisting traders with any inquiries or issues they may encounter.

8. Nadex Fees and Costs

When trading on Nadex, traders should be aware of the fees associated with their transactions. These fees may include trading fees, withdrawal and deposit fees, and inactivity fees. It’s essential to factor in these costs when calculating potential profits or losses from trades.

9. Nadex Security Measures

Nadex prioritizes the security of its users’ accounts and transactions. The platform employs robust security measures to safeguard against unauthorized access and fraudulent activities. Additionally, Nadex complies with regulatory requirements to ensure a safe and secure trading environment.

10. Tips for Trading on Nadex

To maximize success on Nadex, traders should employ effective risk management strategies, develop sound trading plans, and conduct thorough market analysis. By staying disciplined and informed, traders can increase their chances of profitability on the platform.

11. Nadex vs. Other Trading Platforms

Nadex differs from traditional brokers and other binary options platforms in several ways. Its regulatory status, limited risk trading model, and transparent marketplace set it apart from competitors. Traders should carefully evaluate their trading needs and preferences when choosing a platform.

12. Testimonials from Nadex Users

Many traders have found success on Nadex, citing its regulated environment, limited risk trading, and diverse range of trading instruments as key factors contributing to their profitability. However, individual results may vary, and traders should conduct their research before engaging with the platform.

13. Conclusion

In conclusion, Nadex remains a prominent player in the binary options trading space in 2024. With its regulatory oversight, user-friendly interface, and commitment to security, Nadex continues to attract traders looking for a reliable and transparent trading platform.

14. FAQs

- Is Nadex regulated? Yes, Nadex is regulated by the Commodity Futures Trading Commission (CFTC) in the United States.

- What markets can I trade on Nadex? Nadex offers trading opportunities in forex, commodities, stock indices, and economic events.

- Are there any fees associated with trading on Nadex? Yes, Nadex charges various fees, including trading fees, withdrawal and deposit fees, and inactivity fees.

- Can I trade on Nadex from outside the United States? Yes, Nadex accepts traders from various countries, but some restrictions may apply based on regulatory requirements.

- Is Nadex suitable for novice traders? While Nadex offers educational resources and a user-friendly interface, the complexity of trading strategies may pose challenges for novice traders.

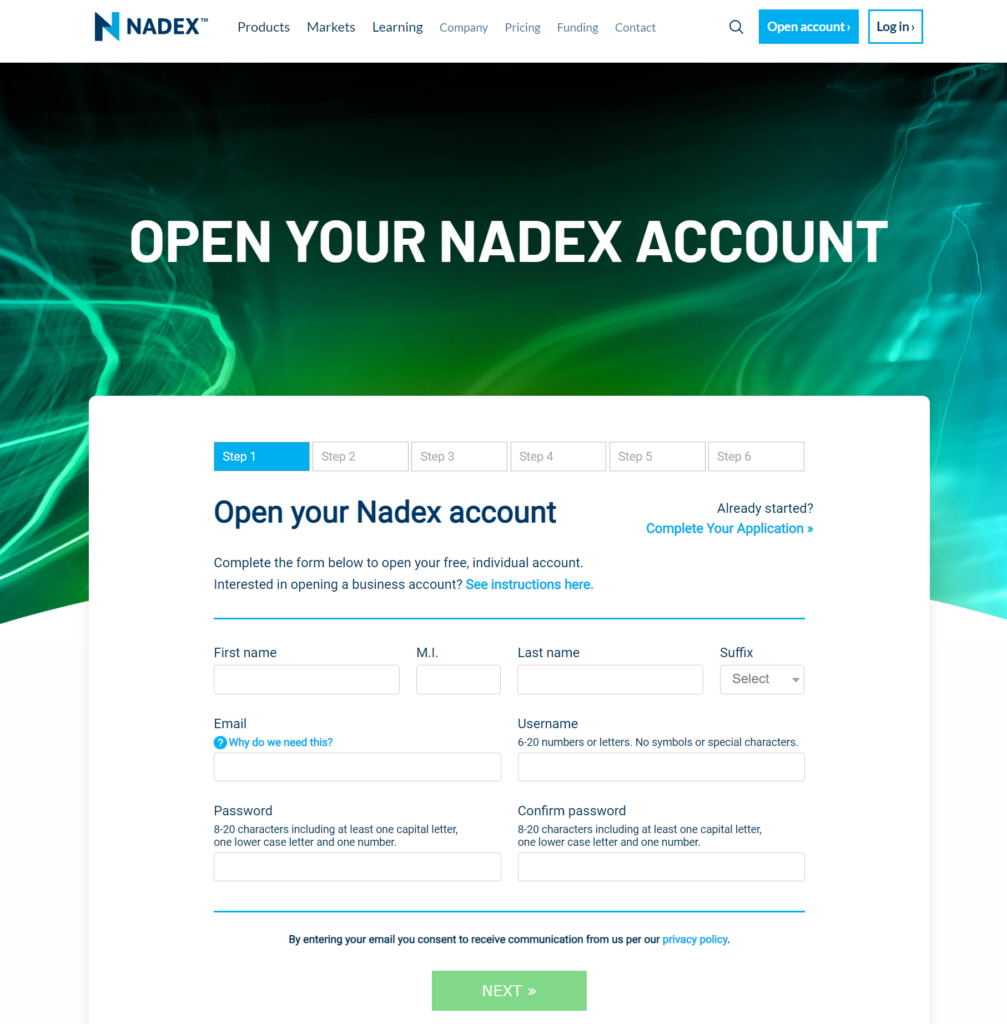

Sure, here’s a step-by-step guide on how to open an account on Nadex:

- Visit the Nadex website: Go to the official Nadex website using your web browser.

- Click on “Open an Account”: Look for the option to open an account on the homepage and click on it.

- Fill out the registration form: Provide your personal information, including your name, email address, and phone number.

- Choose your account type: Select whether you want to open an individual or joint account.

- Verify your identity: Upload copies of your identification documents, such as a driver’s license or passport.

- Agree to the terms and conditions: Read through the terms of service and agree to them to proceed.

- Fund your account: Deposit funds into your account using a bank transfer or debit/credit card.

- Complete the verification process: Wait for Nadex to verify your identity and account information.

- Start trading: Once your account is approved and funded, you can start trading binary options and spreads on the Nadex platform.

- Keep your account secure: Set up two-factor authentication and use a strong password to protect your account from unauthorized access.

That’s it! You’ve successfully opened an account on Nadex and can begin trading.

Leave a Reply