Founded in 1998, Alpari is a well-established online forex and CFD broker. With over two decades of experience in the financial markets, Alpari has earned a reputation for providing reliable trading services to clients worldwide. The company has grown significantly over the years, offering a wide range of trading instruments and cutting-edge technology to facilitate efficient trading.

Alpari’s Trading Platforms

Alpari offers a variety of trading platforms to cater to the diverse needs of traders. Among these platforms are MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are renowned for their user-friendly interface and advanced trading tools. Additionally, Alpari provides a mobile app that allows traders to access their accounts and trade on the go.

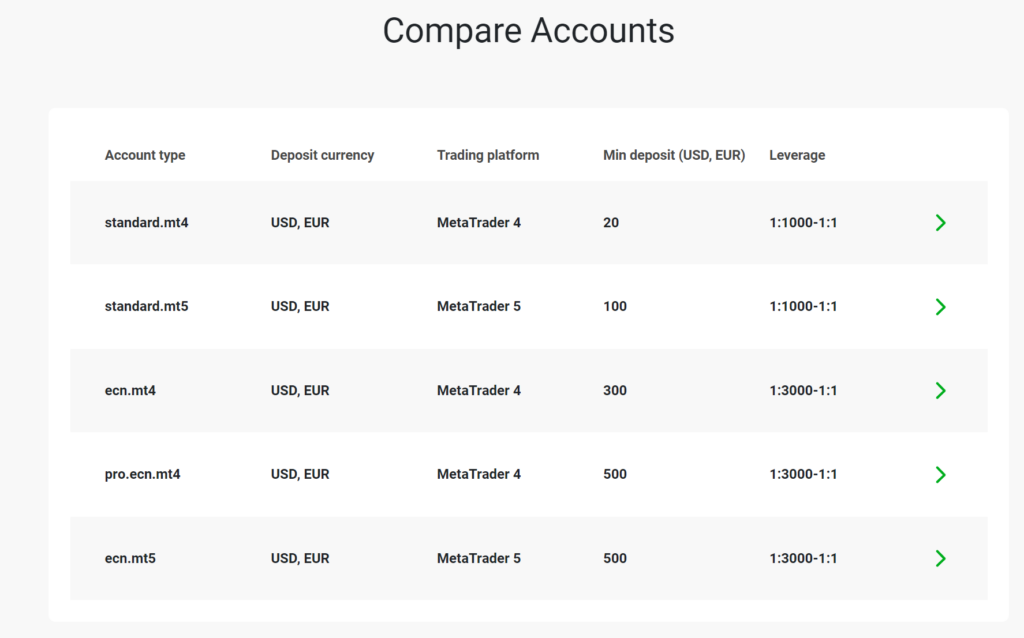

Account Types Offered by Alpari

Alpari offers several types of trading accounts to suit the preferences and trading styles of different clients. These include Standard, ECN, and Pro accounts, each with its own set of features and benefits. The Standard account is ideal for beginners, while the ECN and Pro accounts are designed for more experienced traders who require tighter spreads and faster execution.

Trading Instruments Available

Traders at Alpari have access to a wide range of financial instruments, including forex, cryptocurrencies, stocks, and indices. This allows traders to diversify their portfolios and take advantage of various market opportunities.

Alpari’s Trading Conditions

Alpari offers competitive trading conditions, including tight spreads, flexible leverage, and fast execution. The minimum deposit requirement is relatively low, making it accessible to traders of all levels.

Deposits and Withdrawals

Depositing and withdrawing funds from an Alpari trading account is quick and convenient, with a variety of payment methods available. Transactions are processed promptly, and the company does not charge any hidden fees for deposits or withdrawals.

Customer Support

Alpari provides excellent customer support to assist traders with any questions or issues they may encounter. Support is available 24/5 via phone, email, and live chat, and the company is known for its prompt and helpful responses.

Security Measures

As a regulated broker, Alpari adheres to strict security measures to protect clients’ funds and personal information. The company is licensed and regulated by reputable financial authorities, and client funds are held in segregated accounts for added security.

Education and Resources

Alpari offers a wealth of educational resources to help traders improve their skills and knowledge. This includes a trading academy, webinars and seminars, and daily market analysis to keep traders informed of market trends and opportunities.

Pros and Cons of Alpari

Pros:

- Wide range of trading instruments

- Competitive trading conditions

- Excellent customer support

- Regulated and trustworthy broker

Cons:

- Limited research tools

- No cryptocurrency wallet

Conclusion

In conclusion, Alpari is a reputable and reliable broker that offers a comprehensive range of trading services to clients worldwide. With its user-friendly platforms, competitive trading conditions, and excellent customer support, Alpari is an excellent choice for traders of all levels.

FAQs

- Is Alpari a regulated broker?

- Yes, Alpari is regulated by reputable financial authorities, ensuring the safety and security of clients’ funds.

- Can I trade cryptocurrencies with Alpari?

- Yes, Alpari offers cryptocurrency trading on its platform, allowing traders to take advantage of the volatility in the crypto markets.

- What are the minimum deposit requirements?

- The minimum deposit requirement varies depending on the type of account you choose, but it is relatively low compared to other brokers.

- How can I contact Alpari’s customer support?

- Alpari’s customer support team is available 24/5 via phone, email, and live chat to assist you with any questions or issues you may have.

- Is Alpari suitable for beginners?

- Yes, Alpari offers a Standard account that is specifically designed for beginners, making it an ideal choice for those who are new to trading.

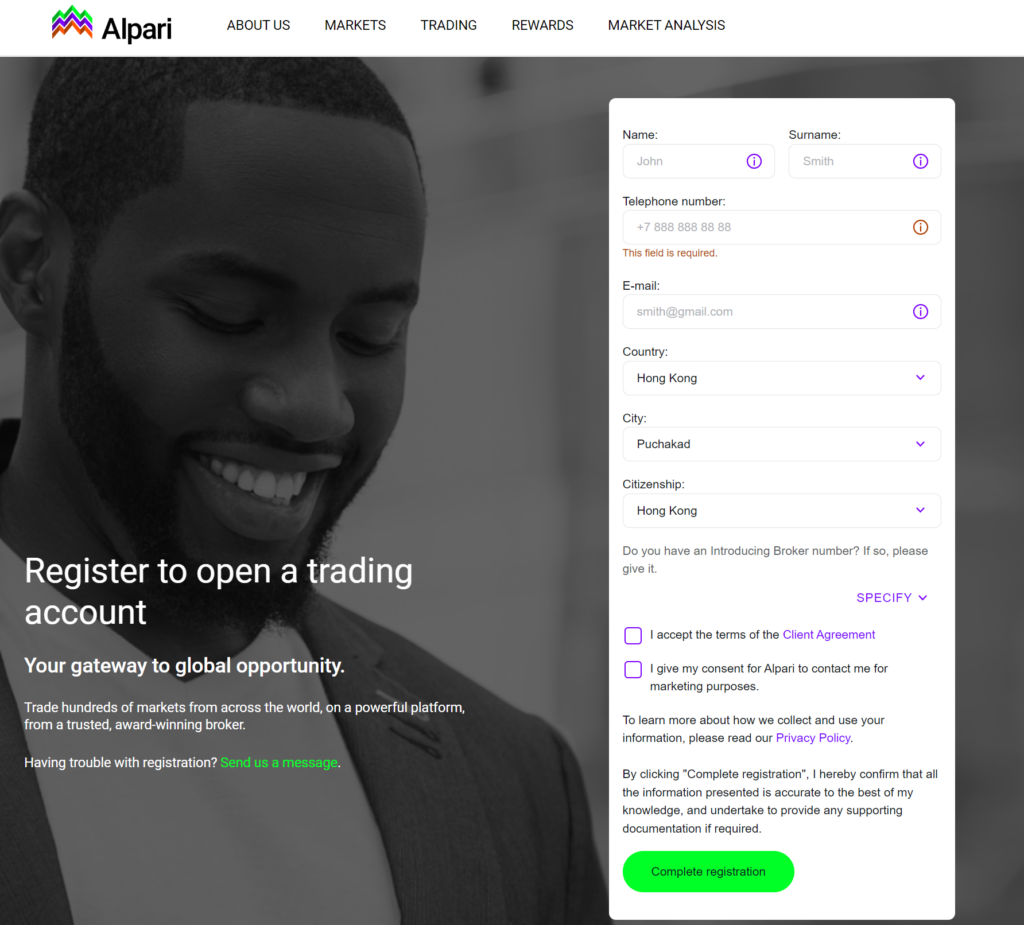

Step-by-Step Guide to Opening an Account with Alpari:

- Visit Alpari’s Website: Go to the official website of Alpari.

- Click on ‘Open Account’: Look for the ‘Open Account’ or ‘Register’ button on the homepage and click on it.

- Fill in Personal Information: Provide your personal details such as name, email address, and phone number.

- Choose Account Type: Select the type of trading account you want to open (e.g., Standard, ECN, Pro).

- Verify Identity: Upload a copy of your identification document (e.g., passport or driver’s license) to verify your identity.

- Agree to Terms and Conditions: Read and agree to the terms and conditions of Alpari’s services.

- Submit Application: Review your information and submit your account application.

- Deposit Funds: Once your account is approved, deposit funds into your account using the available payment methods.

- Start Trading: After funding your account, you can start trading forex, cryptocurrencies, stocks, and other financial instruments offered by Alpari.

- Optional: Download Trading Platform: Download and install the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platform to access advanced trading tools and features.

- Manage Your Account: Monitor your trades, manage your account settings, and explore educational resources provided by Alpari to enhance your trading experience.

Opening an account with Alpari is a straightforward process that can be completed in just a few simple steps, allowing you to start trading quickly and efficiently.

Leave a Reply