In the ever-evolving landscape of online trading, Interactive Brokers (IBKR) continues to stand out as a leading platform for traders and investors seeking comprehensive market access, advanced trading tools, and competitive pricing. Our detailed 2024 review of Interactive Brokers delves into its offerings, technology, fees, and customer support, providing a clear picture of what traders can expect from this powerhouse broker.

Comprehensive Market Access

Interactive Brokers offers an unparalleled range of markets, allowing clients to trade stocks, options, futures, forex, bonds, ETFs, and funds on over 135 market destinations worldwide. This extensive global access makes it an ideal platform for traders looking to diversify their portfolios across different asset classes and international markets.

Advanced Trading Technology

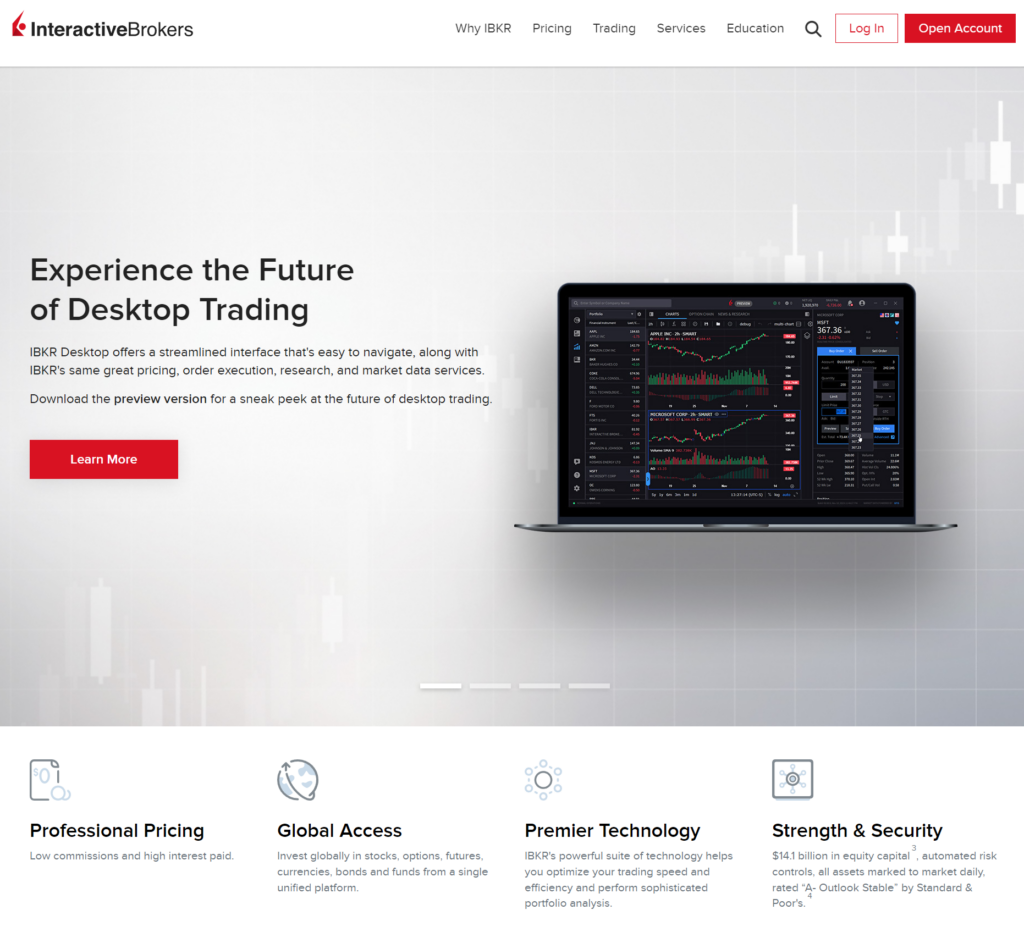

At the heart of Interactive Brokers’ offering is its robust trading technology. The Trader Workstation (TWS) platform provides traders with a powerful suite of tools designed for professional-level trading. TWS includes advanced charting, a vast array of technical indicators, real-time news, risk management tools, and the ability to run algorithmic trading strategies. Furthermore, IBKR Mobile offers traders the flexibility to manage their accounts and trade on-the-go from their smartphones or tablets.

Competitive Pricing

Interactive Brokers is renowned for its competitive pricing structure, catering to active traders and institutional investors alike. The broker offers two main pricing plans: a fixed rate and a tiered pricing scheme. The fixed-rate plan includes a set commission per share or a percentage of trade value, while the tiered pricing offers lower costs for higher volume trading. Moreover, IBKR provides low margin rates, making it a cost-effective option for traders who utilize leverage.

Comprehensive Research and Education Tools

IBKR excels in offering a wide array of research and educational resources. Traders have access to free market research from over 100 providers, including leading financial news outlets and research firms. The IBKR Traders’ Academy is a notable highlight, offering courses and webinars designed to enhance trading knowledge and skills at all levels.

Customer Support

Interactive Brokers provides robust customer support through multiple channels, including 24/6 phone support, live chat, and email. Traders can expect knowledgeable assistance for their queries, whether it’s about account setup, trading tools, or complex trading strategies.

Security and Regulation

Security is paramount at Interactive Brokers, which employs state-of-the-art security features to protect clients’ assets and information. IBKR is regulated by top-tier financial authorities, including the SEC and FINRA in the United States, ensuring a high level of regulatory oversight and investor protection.

Conclusion

Interactive Brokers continues to set the standard for online trading with its comprehensive market access, cutting-edge technology, competitive pricing, and a wealth of educational resources. Whether you’re a novice trader or a seasoned professional, IBKR offers the tools and services needed to navigate the markets effectively. With its commitment to innovation and client satisfaction, Interactive Brokers remains a top choice for traders worldwide in 2024.

Step-by-Step Guide to Opening an Account with Interactive Brokers

- Visit Website: Go to the Interactive Brokers website.

- Start Application: Click on the “Open Account” button.

- Select Account Type: Choose between individual, joint, or institutional account types.

- Provide Personal Information: Fill in your name, address, email, and phone number.

- Employment Details: Enter your employment status and employer information, if applicable.

- Financial Information: Input your financial status, including net worth and income.

- Investment Experience: Describe your trading experience and objectives.

- Read Agreements: Carefully review all terms and conditions.

- Submit Application: Confirm the details and submit your application.

- Verification: Verify your identity by uploading required documents (e.g., ID, proof of address).

- Fund Account: Once approved, fund your account using the provided methods.

- Start Trading: After funding, you can begin trading on the platform.

Leave a Reply