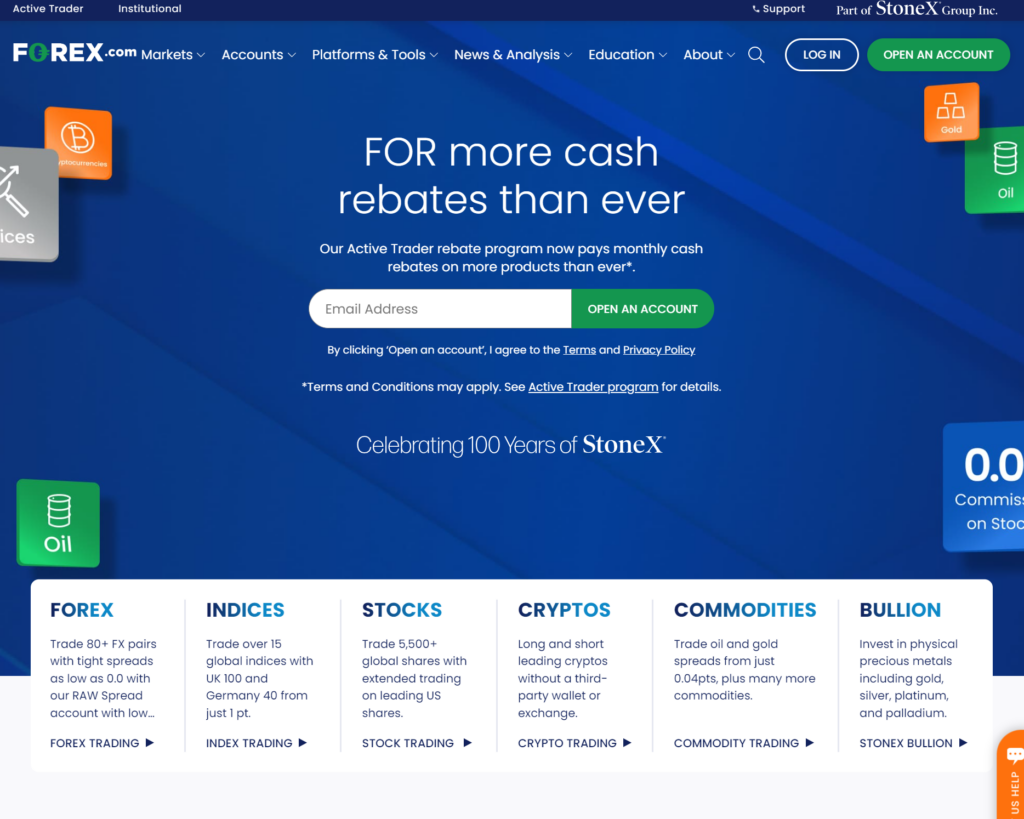

In the dynamic world of online trading, selecting the right broker can be the cornerstone of a successful investment strategy. FOREX.com stands out as a leading figure in the forex and CFD trading arena, offering a robust platform that caters to traders of all levels across the globe. This comprehensive review for 2024 delves into the various aspects of FOREX.com, from its trading platforms and tools to its regulatory framework, customer service, and educational resources, providing an insightful guide for anyone considering FOREX.com as their broker of choice.

Regulatory Compliance and Security

FOREX.com is highly regarded for its commitment to regulatory compliance and security, operating under the strict oversight of several reputable regulatory bodies, including the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and other regulatory authorities worldwide. This multi-jurisdictional oversight ensures that traders’ funds are secure and that the broker operates with transparency and integrity.

Trading Platforms and Tools

FOREX.com offers a variety of trading platforms to suit the needs of different traders, including the popular MetaTrader 4 (MT4), its advanced successor MetaTrader 5 (MT5), and the broker’s proprietary platform, Advanced Trading Platform. Each platform is equipped with a suite of powerful trading tools, real-time data, and advanced charting capabilities, enabling traders to analyze the markets effectively and execute trades with precision.

Product Offerings

Traders at FOREX.com have access to a wide range of financial instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies. This diverse selection allows traders to diversify their portfolios and take advantage of market opportunities across different asset classes.

Educational Resources and Support

Understanding the importance of education in trading success, FOREX.com provides an extensive library of educational materials, including webinars, e-books, articles, and training videos. These resources are designed to help traders of all levels improve their trading skills and knowledge. Additionally, FOREX.com’s customer support team is available 24/5 to answer any queries and provide assistance whenever needed.

Spreads, Fees, and Account Types

FOREX.com offers competitive spreads and transparent pricing across all its account types. Traders can choose from several account options, including standard, commission, and Direct Market Access (DMA) accounts, each tailored to different trading strategies and preferences. The broker’s transparent fee structure ensures that traders understand their trading costs upfront, with no hidden charges.

Execution Speed and Reliability

With a state-of-the-art network of servers and a commitment to low-latency execution, FOREX.com ensures that traders’ orders are executed swiftly and reliably, minimizing slippage and maximizing trading efficiency. This high level of performance is crucial for traders who rely on fast execution to take advantage of market movements.

Mobile Trading

Recognizing the need for flexibility in today’s trading environment, FOREX.com offers a mobile trading app that allows traders to access their accounts and trade from anywhere, at any time. The app combines a user-friendly interface with advanced trading features, making it easy for traders to manage their investments on the go.

Conclusion

In summary, FOREX.com presents a compelling option for traders seeking a reliable, regulated broker with a comprehensive suite of trading tools and resources. Its dedication to regulatory compliance, security, and customer support, combined with competitive spreads and a wide range of financial products, make it a preferred choice for traders worldwide. Whether you’re a novice trader looking to learn the ropes or an experienced investor seeking a robust trading platform, FOREX.com caters to all your trading needs.

Step-by-Step Guide to Opening an Account on FOREX.com

- Visit the Website: Go to the FOREX.com homepage.

- Choose Your Account Type: Select the type of account you wish to open (e.g., Standard, Commission, or DMA).

- Click ‘Apply Now’: Find and click the ‘Apply Now’ button to start the application process.

- Fill in Personal Details: Enter your personal information, including name, address, and date of birth.

- Complete the Financial Information Section: Provide details about your financial status and investment experience.

- Verify Your Identity: Upload required documents for identity and residency verification (e.g., passport and utility bill).

- Read and Agree to Terms: Carefully read the terms and conditions, then accept them.

- Fund Your Account: Choose a deposit method and add funds to your account.

- Download Trading Platform: Download the trading platform of your choice (e.g., MT4, MT5, or Advanced Trading Platform).

- Start Trading: Log in to your account, analyze the markets, and begin trading.

Ensure you understand the risks involved in trading and seek advice if necessary.

Leave a Reply