Established in Australia in 2006, GO Markets has expanded into a respected global forex and CFD broker. They hold regulatory licenses with top-tier entities like ASIC, making them a potentially safe and transparent choice for traders. But does GO Markets live up to the hype? This in-depth review explores their platforms, fees, customer support, and more to help you decide if they’re the right broker for you.

Trading Platforms

GO Markets puts the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms at your fingertips. Both offer extensive charting, technical indicators, backtesting capabilities, and support algorithmic trading via Expert Advisors (EAs). If you prefer a browser-based experience, GO Markets offers a robust web trading platform accessible without downloads. Additionally, their mobile apps make trading on the go a seamless experience.

Account Types

Choosing between the Standard Account or GO Plus+ Account is essential. The Standard Account boasts commission-free spreads, while the GO Plus+ involves commissions but offers tighter spreads. Opening an account with GO Markets is typically straightforward and completely digital. Minimum deposit requirements vary by account type and your region.

Fees and Spreads

GO Markets is relatively transparent about its fees. Forex spreads often fluctuate but tend to be competitive, especially on popular currency pairs. CFD spreads depend on the underlying asset. Be mindful of non-trading fees, such as inactivity charges, that may apply. It’s always best to carefully review the GO Markets fee schedule before getting started.

Education and Research

GO Markets’ commitment to trader education is commendable. Their resources include trading guides, webinars, and courses that cater to both novice and experienced traders. Market analysis is frequent and insightful, but consider supplementing it with your own research for a well-rounded view.

Regulation and Security

GO Markets prioritizes compliance and security. Their primary license with the Australian Securities and Investments Commission (ASIC) signifies strong regulatory oversight. Additional licenses, coupled with segregated client funds and reliable security measures, provide reassurance.

Customer Support

GO Markets shines in customer support. Access live chat, phone, and email assistance – the team is typically responsive and helpful. If you prioritize support availability, you’ll likely be satisfied.

Pros and Cons

Let’s break down some key positives and potential negatives:

Pros

- Competitive spreads

- Excellent educational resources

- Robust trading platforms

- Strong regulatory oversight

Cons

- Limited product range outside of forex and CFDs

- Potential inactivity fees

GO Markets vs. Competitors

GO Markets faces stiff competition within the online brokerage space. Here’s a quick look at how it stacks up against a couple of rivals:

- GO Markets vs. IC Markets: Both are Australian-based with strong ASIC regulation. IC Markets might offer slightly tighter spreads, but GO Markets often excels in customer support and ease of use.

- GO Markets vs. Pepperstone: Pepperstone provides a wider range of tradable instruments, however, educational resources at GO Markets may be considered superior.

Who is GO Markets Best For?

GO Markets caters well to a few specific trader profiles:

- Forex traders: Competitive spreads, particularly on major pairs, and top-tier platforms make it a solid choice.

- Beginners: The abundance of educational resources creates a supportive learning environment for those new to trading.

- Traders prioritizing high-quality support: Responsive, knowledgeable assistance is easily accessible.

Conclusion

GO Markets demonstrates solid execution in many areas crucial for traders. They offer competitive fees, reliable platforms, excellent educational material, and a strong focus on regulation and security. While potentially not the ideal fit for those seeking a very broad range of instruments, GO Markets is certainly a trusted contender for online trading. If you’re primarily a forex trader desiring top-notch support and learning opportunities, they are worth serious consideration.

FAQs

- Is GO Markets a safe broker? Yes, GO Markets’ extensive regulation, including ASIC oversight, indicates focus on client safety.

- What account types does GO Markets offer? Primary options are the commission-free Standard Account and the spread-plus-commission GO Plus+ Account.

- How much is the minimum deposit with GO Markets? The minimum deposit can vary depending on your chosen account type and specific region.

- Does GO Markets have good customer service? Generally, customer support is a strong point of GO Markets, offering timely and efficient assistance.

- Does GO Markets offer educational resources? Yes, they provide an extensive and high-quality educational library suitable for different skill levels.

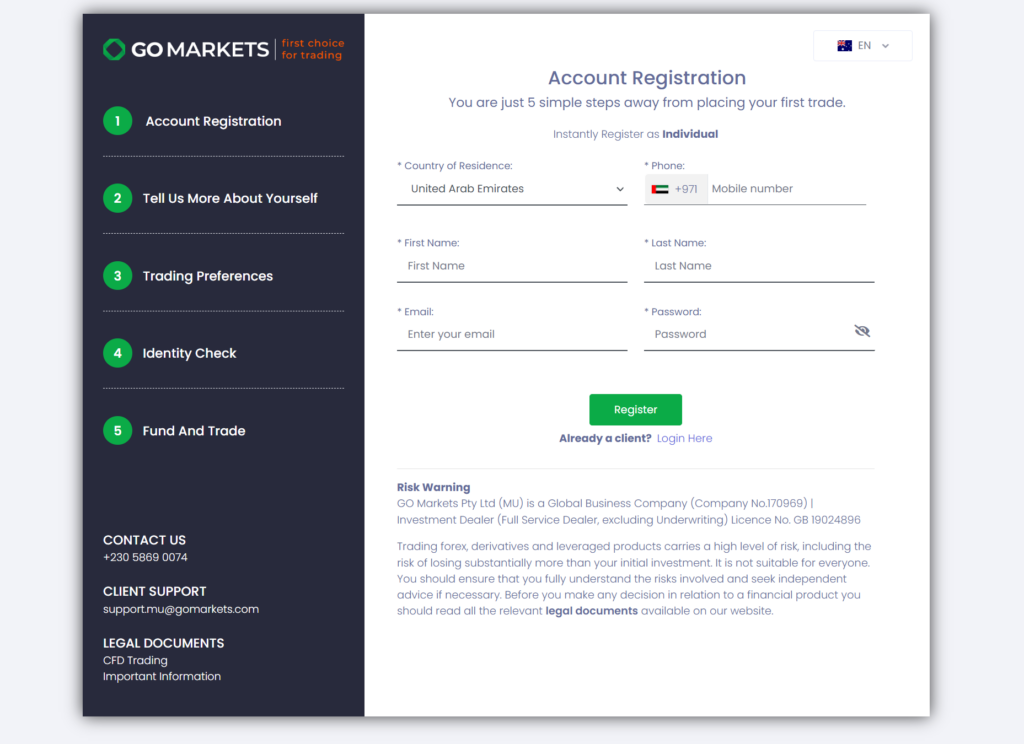

Step-by-Step Guide: How to Open an Account with GO Markets

- Visit the GO Markets website: Look for a button like “Open an Account” or “Sign Up.”

- Account type: Select the desired account type (Standard or GO Plus+).

- Personal information: Provide basic details like name, email, and country of residence.

- Verification: You’ll likely need to upload identification documents (e.g., passport) and proof of address to comply with regulations.

- Funding: Once approved, choose a deposit method and transfer funds to your new account.

- Start trading: You’re ready to access GO Markets platforms and place your first trades!

Important to Note: The availability of services and account features may vary depending on your jurisdiction. Always consult the GO Markets terms and conditions on their website for the most up-to-date information.

Leave a Reply