Blueberry Markets is a prominent name in the world of online trading, offering a wide range of financial instruments and services to traders worldwide. Established with a commitment to providing a seamless trading experience, Blueberry Markets has gained recognition for its reliability, transparency, and client-oriented approach.

Overview of Blueberry Markets Services

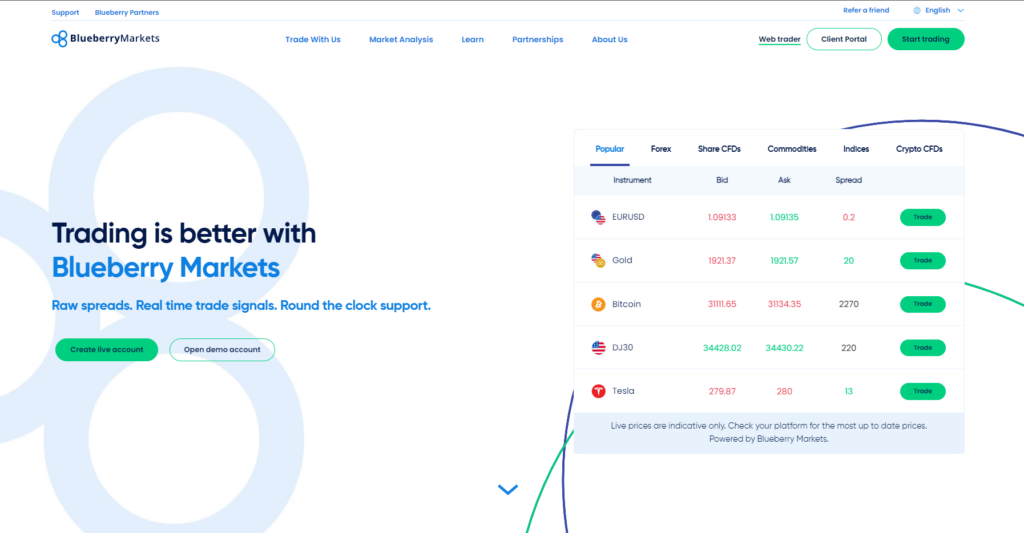

Blueberry Markets caters to the diverse needs of traders by offering an extensive range of trading instruments, including forex, commodities, indices, and cryptocurrencies. The platform provides access to multiple account types tailored to suit different trading preferences, from beginners to experienced professionals. Additionally, traders can choose from a variety of trading platforms, including MetaTrader 4 and MetaTrader 5, renowned for their advanced features and user-friendly interface.

Regulation and Safety Measures

One of the key aspects that set Blueberry Markets apart is its commitment to regulatory compliance and client safety. The company is regulated by the Australian Securities and Investments Commission (ASIC), ensuring adherence to stringent regulatory standards and providing traders with peace of mind regarding the safety of their funds and personal information.

Trading Conditions

Blueberry Markets offers competitive trading conditions, including tight spreads, low commissions, and flexible leverage options. With lightning-fast execution speeds and reliable trade execution, traders can capitalize on market opportunities with precision and efficiency.

Deposits and Withdrawals

Depositing and withdrawing funds with Blueberry Markets is a seamless process, with a variety of secure payment methods available, including bank wire transfers, credit/debit cards, and popular e-wallets. The platform prioritizes fast processing times and ensures hassle-free transactions for its clients.

Customer Support and Education Resources

Blueberry Markets takes pride in its exceptional customer support team, comprising experienced professionals dedicated to assisting traders with any queries or issues they may encounter. In addition to personalized support, the platform offers a wealth of educational resources, including trading guides, webinars, and market analysis, empowering traders to enhance their knowledge and skills.

Pros and Cons of Blueberry Markets

Pros:

- Regulated and reputable broker

- Wide range of trading instruments

- Competitive trading conditions

- User-friendly trading platforms

- Responsive customer support

Cons:

- Limited presence in some regions

- No proprietary trading platform

Conclusion

In conclusion, Blueberry Markets stands out as a reliable and trustworthy broker, offering a comprehensive suite of services designed to meet the diverse needs of traders. With its commitment to regulatory compliance, competitive trading conditions, and exceptional customer support, Blueberry Markets remains a top choice for both novice and experienced traders alike.

FAQs

- Is Blueberry Markets regulated?

- Yes, Blueberry Markets is regulated by the Australian Securities and Investments Commission (ASIC), ensuring compliance with stringent regulatory standards.

- What trading platforms does Blueberry Markets offer?

- Blueberry Markets offers access to MetaTrader 4 and MetaTrader 5, two of the most popular and widely used trading platforms in the industry.

- Are there any deposit or withdrawal fees?

- Blueberry Markets does not charge any deposit or withdrawal fees. However, fees may be imposed by payment processors or banks.

- Does Blueberry Markets offer educational resources for traders?

- Yes, Blueberry Markets provides a variety of educational resources, including trading guides, webinars, and market analysis, to help traders enhance their skills and knowledge.

- Can I trade cryptocurrencies with Blueberry Markets?

- Yes, Blueberry Markets offers cryptocurrency trading, allowing traders to speculate on the price movements of popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

Leave a Reply